Post COVID-19 World: The Bullish Case for (early stage) VCs & Founders [Part 1]

Early-stage venture capitalists are in the business of hitting targets most people cannot see. Our focal point is usually set 3 to 5 years into the future. We often discover a future that is already available today but is not yet evenly distributed.

This is why founders, like early-stage VCs, need to be visionaries and look beyond the horizon. Many people are struggling to think past tomorrow, especially when the present is uncertain, and the specter of recession looms with skyrocketing unemployment claims as shown in The New York Times recently.

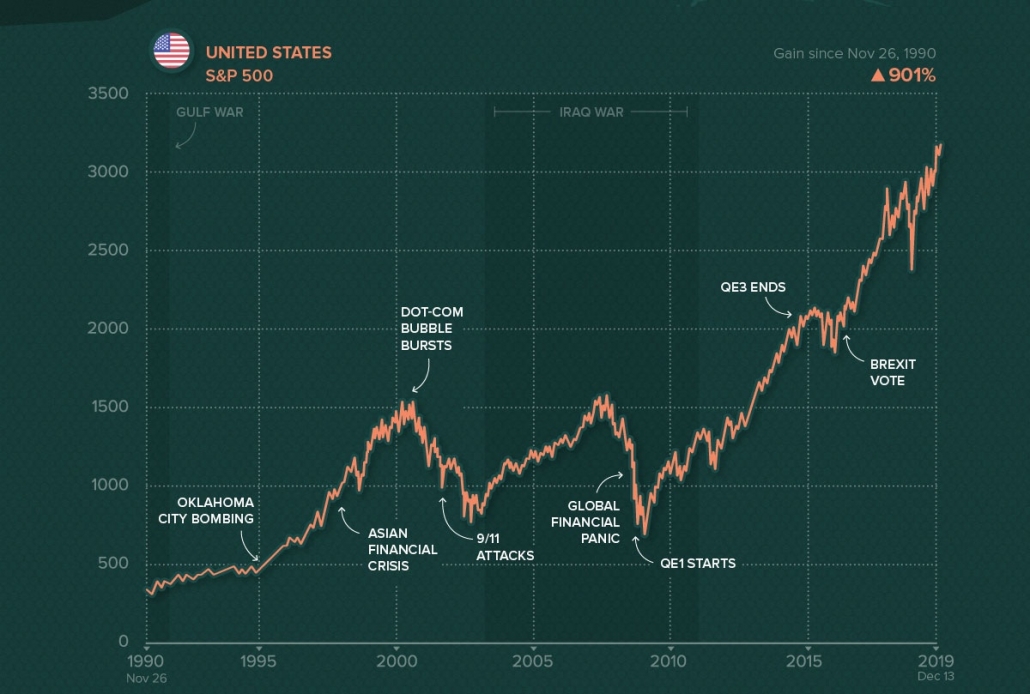

Being born in the mid 70’s during the first oil price shock, I am old enough to remember working my way through several major crises including the Asian Financial Crisis (1997), the Dot-Com Bubble Burst (2000), 9/11 (2001), the Global Financial Crisis (2007), and now, the COVID-19 Pandemic. Today, I find myself managing and investing venture capital on behalf of financial institutions, corporations, and wealthy families (most of whom became wealthy as a result of entrepreneurial endeavors). Below is a chart that puts these crises, and their impact on the S&P 500 in perspective.

And here is a close-up of the 10+ year bull market we experienced, and the recent drop caused by the COVID-19 pandemic:

While things always seem worse when you are in the midst of it and the lives of you and your loved ones get impacted, you need to remember that humanity, and our economies, are more resilient than we tend to believe. Through innovation, solidarity, and leadership, things do get better, and often even better than they were before the crisis hit. These crises tend to reveal quickly and dramatically everything that is wrong, broken, or plain backwards in our society, and give us the opportunity to learn, and spring forward to rebuild a better world.

The scale and speed of this pandemic is unprecedented in modern history, but we also have the technology and knowledge to solve for it in unprecedented ways.

Impact on the Venture Funding Environment

Limited Partners

I recently spoke with the head of venture investment of a large public pension fund and the conversation went something like this: “Putting public markets and other asset classes aside, we are pretty comfortable with our seed fund allocations and believe they are in a strong position to take advantage of this market turn-around. This is something we saw in 2000-2001, and again in 2007-2008…we are more concerned with our later stage/growth fund allocations, as recent years have seen very high valuations, the IPO window is likely to remain shut for a prolonged period of time, and some companies have considerable operational loses, which they justified with fast growth…but that may no longer be sustainable.”

As illustrated by the chart below, the US seed stage market will remain the most attractive risk/return segment of the market.

This white paper from Invesco explains why limited partners should consistently invest in the venture capital asset class, in up and down cycles, while this blog post does a pretty good job of explaining that we are not in a recession following a global financial meltdown like the one we witnessed in 2007-08, nor are we in a recession caused by a war triggered by a shocking act of terrorism like 9/11, but that we are in a sudden global economic recession due to the consequences of a global health crisis.

While some of the indicators may have pointed to the end of the bull market for the past few months, the economy, job market, and other key indicators were not in the red before this health crisis. Once uncertainty (and fear-driven, irrational exuberance) are removed from the market, people will regain confidence in our ability to get this virus under control, and the path to a recovery will emerge.

I will focus my thoughts on the Seed and Series A stage in this post, since this is where we invest.

Seed Stage

Early stage funding is likely to suffer most in the short term as high-net-worth individuals and angel investors who flooded the market in boom years will retract from the market. Because of the level of noise pre-COVID 19, and the lack of traditional metrics to assess opportunities at that stage, we expect many companies that were funded (and probably should not have been) will not be able to secure additional capital and will fail (or find safe harbor in the hands of a strategic, or negotiate an acquihire), effectively purging the market. After the initial shock, we may see angel investors returning to the market like we saw in 2007-2008 as valuations get lower and they see a “good deal” for their money. Experienced investors, able to perform institutional level due diligence at velocity, will be able to secure great deals/value. A similar flight to quality will happen, and institutional seed fund managers like BootstrapLabs are well positioned to benefit from this “buy-side” driven environment.

Series A Stage

Several Series A stage venture firms raised a lot of “dry powder” in the last 18 months (e.g, Sequoia, Andressen Horowitz, Lightspeed, NEA, etc.), resulting in over $276B available for the best startups reaching that stage and beyond. We expect a similar flight to quality and only top teams and companies with demonstrated traction will receive follow-on funding. But this is not much different from pre-COVID-19 criteria (and BootstrapLabs’ portfolio companies have fared better than most in that area, as demonstrated by our current 48% conversion rate from Seed to Series A within a short 3 year period).

Here is a chart of the venture capital industry since the last Global Financial Crisis. The market has grown significantly since 2008, mostly driven by a bull market, lower returns in the public sector, delayed IPOs, and late-stage mega-rounds, which really should be considered “Growth Financing” rather than Venture Capital as Mark Suster said in his presentation here.

Back in 2015-2016, BootstrapLabs was among the first seed VC firms to recognize the opportunity to invest in Applied AI technology startups that were solving large and valuable problems by leveraging recent advances in computing power, broadband, and the data explosion. 3-4 years later, Applied AI adoption is still in its infancy and continues to attract a growing portion of the venture capital deals, especially around enterprise/industrial automation, cybersecurity, healthcare, mobility, etc.

What about Corporate Venture Capital (CVC)?

CVCs have been increasingly active over the past decade of bull markets, and last year were involved in approximately 30% of all venture financing rounds.

During the Dot-Com Bubble Burst, CVC seriously retracted from venture investments, and most did not return until after the Global Financial Crisis. Since a large number of CVC still invest from their balance sheet, one of the first things corporations may do to preserve cash is to reduce their CVC budget or allocation. I would not be surprised to see a 25-30% pull back in the market, but the wiser corporations will learn from the past and stay active in this coming market.

Corporations that did not have CVC programs in place before this crisis will likely need to jumpstart their efforts by setting up shop sooner rather than later, partnering with groups like Silicon Foundry, or finding (earlier stage focused) VC funds to work with via Limited Partnership Investments (usually a much faster – and often more successful – way to tap into specific sector of the startup innovation ecosystem).

CVC arms are a key component to accelerate knowledge and access to outside innovation, and will need to go hand in hand with M&A to accelerate a corporation’s transformation. For more information on how and why to set up a CVC, I would recommend my friend Evangelos Simoundis’ blog posts here.

As a VC firm focused on Applied AI, we are working closely with our Corporate Limited Partners, as well as families that own large corporations, to ensure they stay at the forefront of the 4th Industrial Revolution.