Why Artificial Intelligence is the catalyst

Artificial Intelligence is likely one of the biggest disruptions we have seen in modern times (and I have been building technology since the 80’s). It will have a bigger impact than the Internet, Mobile Computing, and Cloud Computing.

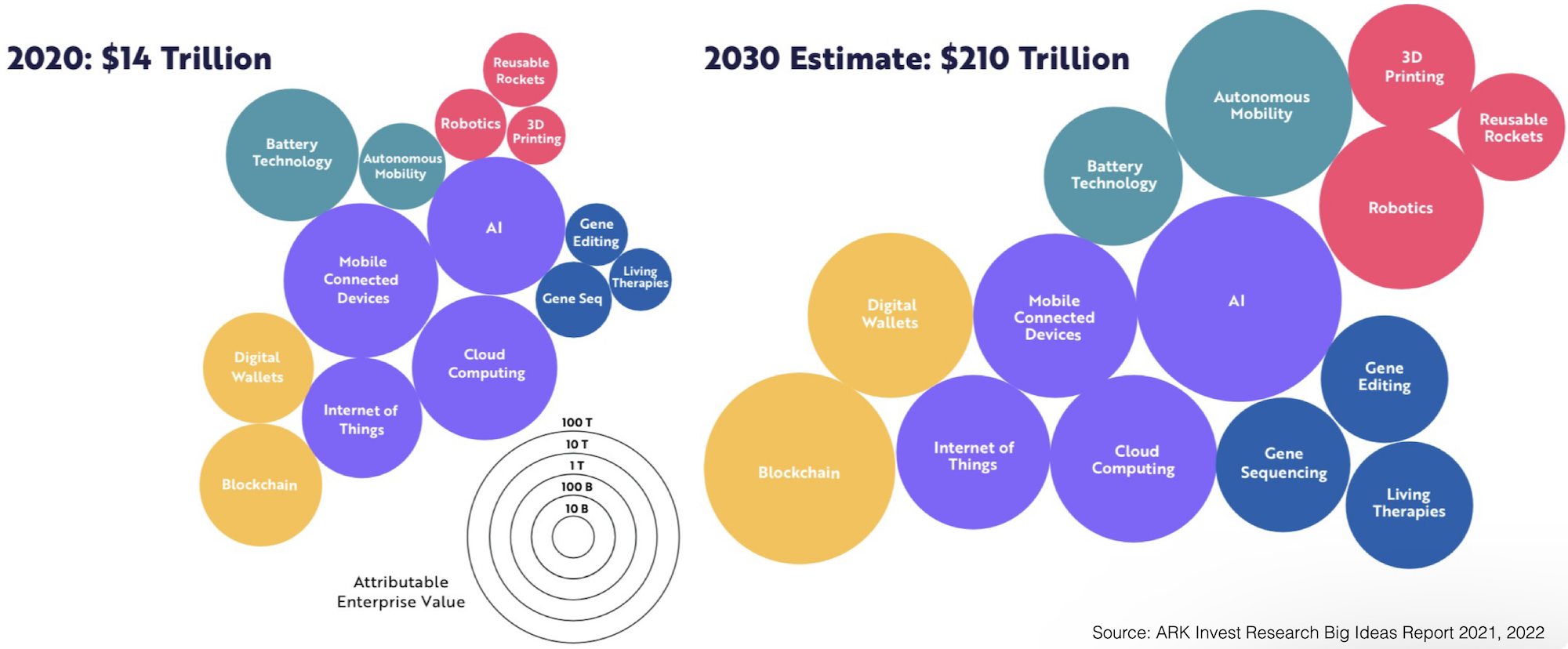

In part, because it builds on the all of them. In part, because our entire society has started to become digital in the past 10 years. In fact, according to ARK Invest’s Big Ideas report, we have seen about $14 trillion of market cap value creation take place in the last 10 years, with an expected growth to $210 trillion in the next 10 years.

Artificial Intelligence is the catalyst

If you look at all of the major disruptive technologies that are expected to re-shape and digitalize our world as part of the next $200 trillion in market cap value creation by 2030 – Artificial Intelligence is not only the biggest part of it – it is also the catalyst for the next wave of digitalization.

Software ate the world, AI is eating software

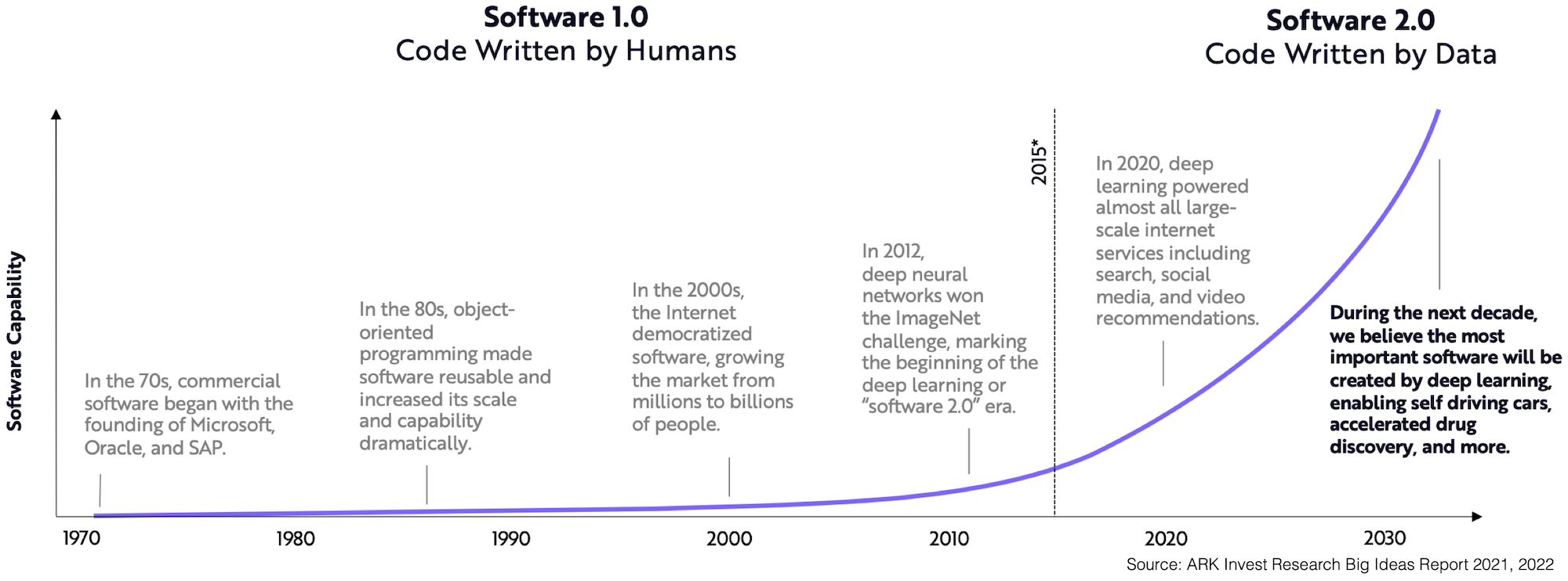

Software ate the world, and AI is eating software – AI is the next generation of software that is written by data instead of humans.

“Software 1.0” was accelerated by Moore’s Law and we are now at the onset of the $87 trillion market cap creation opportunity for Artificial Intelligence or “Software 2.0” that is currently doubling the capacity for training models for one dollar every 9 months (twice as fast as Moore’s law).

Conclusion

BootstrapLabs’ Applied Artificial Intelligence thesis is investing in the ~ $210 trillion market cap value creation opportunity that is created through these emerging technologies – through the investment in Artificial Intelligence itself, and technologies such as Future of Work, Mobility, Health, Financial Infrastructure, Digital Infrastructure, and Energy & Climate.

In contrast to a generalist Venture Capital investment thesis, our focus is to pick the opportunities that are able to leverage the next generation software (and AI hardware) technologies to create large efficiencies within this next wave.

The prior wave of large value creation through Venture Capital fund investments was to a large extent powered by “Software 1.0”, we believe that Software 1.0 investments will see diminishing returns, and the next wave of value creation will be powered by “Software 2.0” or in other words Artificial Intelligence (as we are already seeing with our three AI-first focused investment funds).

Why now?

Neural Networks (which we call Deep Learning today) has been around for a long time, why have they not taken off, and had this impact before?

The simple answer is that the compounding effect of Moore’s Law (of doubling compute power for $1 every 18 months), Data Storage efficiency (doubles every 12 months) and Communications Bandwidth (doubles every 9 months) over time allowed us to apply enough compute power to create real utility in the past 7 years.

Faster than Moore’s Law

The amount of AI compute for $1 doubles every 9 months, which is twice as fast as Moore’s Law. This means that OpenAI’s GPT-3 model (175 billion parameters) did cost $875 million 2015 to train, in 2020 that went down to $4.6 million, today (mid 2022) that cost is ~$150K.

The computational power used to train AI models is growing exponentially

The amount of compute power that is being used in the world to train AI models is doubling about every 3 months at this time.

Sources:

- ARK Invest Big Ideas Report 2021 and 2022.

- BootstrapLabs.