Trusted Insight: Disrupting the $6 Trillion Alternative Asset Market

Two weeks ago, we wrote about how AngelList is disrupting the angel investment landscape with its syndication model, and last week we announced our own AngelList syndicate in partnership with Gil Penchina, the #1 AngelList Syndicate lead. Today we would like to tell you about Trusted Insight, a company that is applying the same disruptive syndication model, but to the entire alternative asset industry, not just startup investing and venture capital.

Our recent posts created a lot of engagement and sharing on social media (thank you for that) and were recently reinforced by a series of conversations and posts that emerged from interviews of Naval Ravikant and Gil Penchina at the NVCA Annual Meeting in San Francisco and the Collision Conference in Vegas.

What are Alternative Assets and how big is the industry?

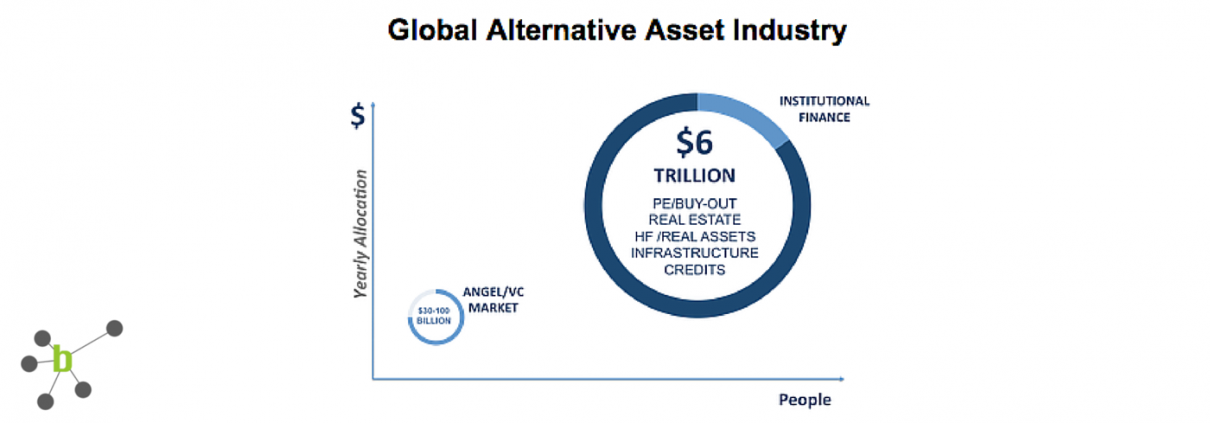

Alternative assets usually include illiquid and private investment opportunities such as Venture Capital, Private Equity, Real Estate, Hedge Funds, Infrastructure, and Illiquid Credits. Institutional investors, including family offices, professional fund managers, endowments, pension funds, and other wealth managers, invest in these “assets” as part of their allocation strategy, either directly or via specialized funds.

Globally, the alternative assets industry represents $6 Trillion each year, dwarfing the $30Bn US Venture Capital Industry.

Why total addressable market and average deal size matters?

Last year, AngelList, the leading startup investment platform, enabled over $100M in private financing, and while not all of these were syndication deals, it is fair to assume that the vast majority were. On average, a syndicate financing on AngelList is ranging from $150K to $500K per deal, with individual angel investor checks ranging from $1K to $100K.

In contrast, a typical investment opportunity at the institutional investor level ranges between $25M to $1Bn per deal (e.g. fund, real estate project, buy-out), with each investment check in the millions, if not tens of millions of dollars.

In other words, the market opportunity is 100 to 1000x bigger than angel and venture investing.

Basic unit economics: private placement fees vs. syndication carry

Traditionally, players in this space have been entrenched in the private placement business model (i.e. broker-dealers regulated by FINRA / SAIC) as it provides them with the following benefits:

- Commissions are paid at closing

- Fee as a percentage of transaction amount provides some level of scalability (linear)

- Commission is “earned”, independently of the investment outcome, successful or not

Fee percentages tend to range from 7%+ for smaller private placements to 1-2% for larger transactions. In the example above, we assumed a 2% fee, given the $100M financing amount.

In contrast, the syndication model provides a profit share return on work performed only if the opportunity that was syndicated in the first place is an overall success, meaning that cash or liquid securities are being delivered to the investors as a result of their ownership of the asset.

An average timeline to exit or return on investment might be 7 years, with some being shorter (rarely) and some being much longer (especially real estate or infrastructure deals). As the platform facilitating these syndicated financing deals, your are now sharing the investment risk but are also looking at a much higher return potential.

Additionally, that increased risk is being mitigated in a few ways:

- Positive selection: for a deal to be syndicated, it needs to be vetted and syndicated by a “lead” who is not only respected as a professional in the space, but who is also investing his own capital, thereby creating long term alignment with fellow investors backing his syndicate/investment opportunity

- Diversification: the syndication model, across alternative assets and geographies, will provides for a natural risk diversification of the “carry portfolio” owned by the platform

- Syndicate lead incentive: syndicate leads will naturally emerge as the platform provides them with a highly efficient and scalable way to syndicate opportunities and capture carry from 3rd party investors that leverage their access, knowledge and expertise. As shown in the table below, the incentive is significant

- Scalability: the marginal effort required to run a new syndication on the platform, including discovery, vetting, marketing, due diligence and closing, will add minimal costs to the platform (compared to a traditional private placement process), while maximizing the overall upside potential

About Trusted Insight and why BootstrapLabs lead their Series A RoundTrusted Insight is a New York-based big data alternative asset management platform disrupting the way institutional investors discover, connect, analyze, and ultimately syndicate deals with one another across different verticals and geographies.

Since its inception, the company has experienced continuous growth and engagement from its user base including many of the world’s largest asset management institutions and family offices, representing over $18 trillion in assets under management globally.

At BootstrapLabs we have known Alex Bangash, the founder of Trusted Insight, for many years and have been tracking the progress of the company since its inception. We have great respect for the work Alex and his team have accomplished thus far and we look forward to contributing our technology and fintech expertise to help the company reach the top.

We believe the winner in the space will need to bring 3 core components to the table:

- Curated professionals engaging via an industry-centric social network driven by content, communication, events and jobs

- Big data analytics, behavioral science, and pattern recognition algorithms enriching user experience and personalization, and facilitating targeted syndication

- Ability to jumpstart the syndication model with proprietary fund-of-funds vehicles that have credibility with the institutional investor community

Overall, the alternative asset industry is ripe for disruption and represents a massive opportunity for those who dare to try.

Alex and his team at Trusted Insight are leaders in this space and we are truly excited to be working closely with them, in true BootstrapLabs’ fashion, to shape the future of the global alternative asset investment space.

Learn more at www.thetrustedinsight.com

(Disclosure: BootstrapLabs is an investors in both AngelList and Trusted Insight.)