BootstrapLabs partners with Gil Penchina, launches AngelList Syndicates

BootstrapLabs is partnering with Gil Penchina, the #1 Syndicate Lead on AngelList with over $6.5M in backing (more info below), and launches its syndicates.

BootstrapLabs is partnering with Gil Penchina, the #1 Syndicate Lead on AngelList with over $6.5M in backing (more info below), and launches its syndicates.

Last week we published the blog post “The rise of Angel(List)” because we felt it was important for the world to wake up to AngelList and its disruptive potential when it comes to angel investing.

At BootstrapLabs we have been early adopters, advocates and investors in AngelList and we have watched the platform evolve and grow. Launched in the fall of 2013, it took some time for the Syndicate business model to take off but it is now here to stay.

By launching our syndicates on AngelList, BootstrapLabs will be able to provide its investors and portfolio companies additional value, which has always been our goal.

Syndication Framework Summary

Initial Seed Investment – BootstrapLabs Seed Fund

All our Seed Investments are made out of BootstrapLabs Seed Fund, where we curate, cherry pick and lead investments into some of the world’s most promising and innovative technology companies. All our portfolio companies go through our 12 months hands-on Lab model.

Follow-on Seed Investment – BootstrapLabs’ Syndicate ($25K lead; $2.5K min. backing)

As our seed portfolio companies start to grow and seek additional capital (before a Series A), we will systematically syndicate a tranche of their new financing to our backers on AngelList using our BootstrapLabs’ Syndicate.

Series A (and up) Investment – BootstrapLabs A+ Syndicate ($25K lead; $2.5K min. backing), in partnership with Gil Penchina

BootstrapLabs will syndicate a tranche of all the Series A (and up) rounds it will participate in (including pro-rata rights from its seed portfolio investments).

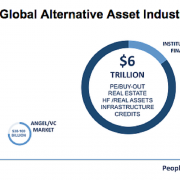

It is interesting to note that until now, very few deals promoted on AngelList have been Series A and up. Angels and accredited investors have historically only been able to access Seed and Pre-IPO stage deals (mostly via secondaries with the right connections), the growth phases – Series A, B, C, D, etc. rounds – have usually been the exclusive playground of VCs and their Limited Partners. Arguably, Angels were left with the two riskiest parts of the equation, very early stage deals with high risks and high rewards, and supposedly lower risks and (most certainly) lower return – due to high pricing – pre-IPO opportunities.

Now, with BootstrapLabs A+ Syndicate, our backers have the ability to invest alongside us across all stages of venture investing.

To engage with the exciting opportunity of AngelList, explore our AngelList Syndicates below:

![]() Our Seed Syndicate

Our Seed Syndicate ![]() Our A+ Syndicate

Our A+ Syndicate ![]() Our AngelList Profile

Our AngelList Profile

About Gil Penchina

Gil has held several executive positions in the Bay area, including eBay, GE and as the CEO of Wikia (now a top 50 website). He has been investing in over 70 companies as an angel investor over the past 17 years and is today one of the most well-known and respected startup investors in Silicon Valley and globally. Some of his well-known investments include companies like LinkedIn, PayPal, AngelList, Evite, Couchsurfing, Wealthfront, Indiegogo and many more. He is currently the #1 Syndicate Lead on AngelList with over $6.5M in backing.

Note: Some information on AngelList may not be available to you if you are not deemed an accredited investor.