How to Milk a Unicorn… No Really, How?

Victoria Silchenko recently posted an article on LinkedIn, Confession of Venture Capitalists: How to milk a Unicorn where she interviewed some high profile VCs and Private Capital experts on the recent “private IPO” trend. Great topic, catchy title and excited that BootstrapLabs will be joining the discussion live at her upcoming Global Alternative Funding Forum on November 6th in Los Angeles. Don’t miss it!

Having lived in Silicon-Valley for over 16 years as an entrepreneur, investment banker and tech investor, I have had the privilege to work with David Weild, count Will Bunker among my friends and co-investors, and have met with both Tim Draper and Andrew Romans. And I cannot help but wonder what the impact of these billion dollar companies going for Private IPOs will be on the liquidity cycle of Venture Capitalists.

I will skip some of the basic premise nicely outlined (or should I say revealed) by David Weild on his research paper, Why are IPOs in the ICU? and outline some of the basic benefits provided by standard IPOs:

- Public visibility with main street on a global scale,

- Increased trust with partners and providers,

- Promise of cheaper and faster access to capital to grow the business, make acquisitions and attract talent,

- Ability to offer liquidity to existing investors that had supported the company until then (average startup age at IPO is 7+ yrs lately, and trending up) as well as employees. These liquidity events do not happen at the IPO stage but usually during a Follow-On (FO) offering, as main investors and management teams are considered insiders and are under lock-up agreements for 180 days post IPO (and subject to trading limitations thereafter).

- Promise of rapid stock price appreciation driven by company’s growth and positive wall street analyst coverage

Now, let’s take a look at the benefits provided by “Private” IPOs:

- Unicorns are enjoying tons of (free) publicity, which could certainly qualify as the equivalent to going “public” from a notoriety stand point,

- While a lot less public (financial and operational) information exists about these Unicorns due to their private status, it is fair to assume that partners and customers alike are more inclined to provide them with the same level of trust, credibility and most favored nation terms as if they were publicly listed companies,

- In the current market, one could easily argue that you can raise faster, cheaper and even more capital in the private market if you are a Unicorn vs. a company filing for an S-1; and the best part of it is not being subjected to daily Wall Street scrutiny as Twitter has painfully experienced in recent months,

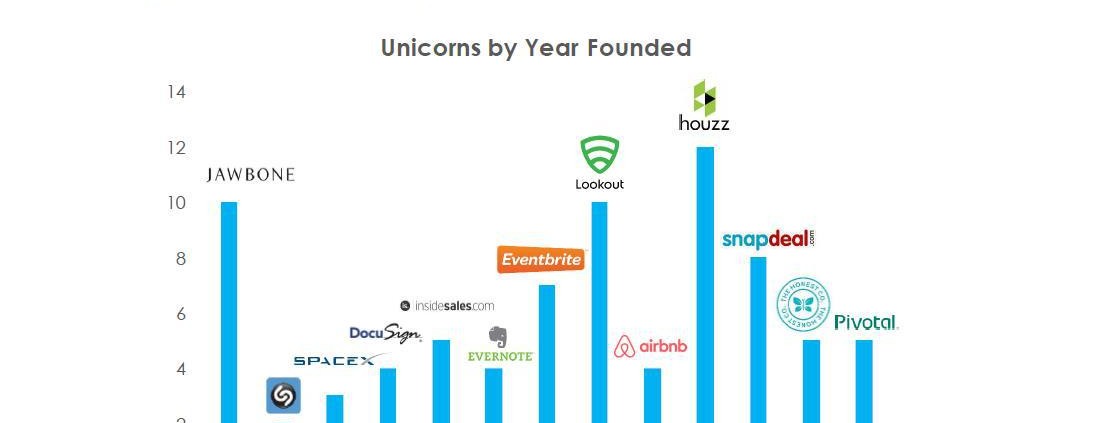

- This one gets interesting. There is little information out there but these large “Private” IPO rounds often include some – at least partial – liquidity for the founders, early investors and sometimes employees. The average Unicorns’ age is about 9+ years according to Beau Laskey at SVB , which is longer than the life of most VC funds. As such, it should come as no surprise that VCs, especially the ones that came in early, would seek liquidity in those later stage mega rounds.

Unicorn are not overnight successes. As the saying goes in Silicon Valley, Overnight Success takes 10 years!

- Valuations are sky-rocketing in the private market once a company reaches Unicorn status…and one has to wonder if it is due to sheer speed of execution and the breath-taking growth rate experienced by these startups, or a demand driven phenomenon where every deep pocket investor wants to ride this rising giant sooner rather than later, and deploy a large chunk of capital into it for a 1.5-3x return. These returns sound really good, especially when you are able to deploy over $100M at a time after some of the major risks appear to have been removed. In comparison, public market returns have eroded and it is getting harder and harder to find alpha at scale.

Unicorn Valuation Surge in the Private Market:

This is a one year old chart: Uber is now worth $10Bn more!

Are Later Stage Investors Valuation Insensitive Due to their Preference?

Andrew Romans had an interesting point in Victoria’s article in that the last money in gets liquidation preference (and sometimes anti-dilution protection in the event of a down round). That would basically make those investors valuation/price insensitive as they would get their money out first in case of trouble and that the valuation of these companies would likely not fall below their investment amounts to begin with. But in case of Qualified IPOs, these liquidation preference would go away and even if the opening price is higher than the last round of funding valuation, nothing would prevent the stock from tumbling down. See this good post on IPO down rounds.

Are Insiders Allowed to Lock-in Profits Quietly?

Another risky dynamic at play here is the liquidity provided to insiders as part of these later rounds. In a public setting, if an insider sells his shares he would need to disclose it to the public; but in those mega rounds of financing, only major investors are posted on the transaction structure, leaving out of the loop a lot of people inside and obviously outside of the company. Wouldn’t you think that knowing that the founder(s) of your company have locked in some of their gains would be important news?

Potential M&A Suitors Evaporating by the Minute

While M&A still represents between 90 and 95% of the return on capital for VCs, the list of potential acquirers for Unicorns is shrinking by the minute as their valuations are significantly higher then those of the very incumbents they seek to disrupt. As an example, Group Accor ($9Bn market cap.) can no longer buy AirBnB ($25Bn).

Ultimately the Losers are Public Institutional and Retail Investors

Maybe a good way to look at what is happening is by drawing a chart with valuation against time, with a typical Unicorn curve, pre- and post- IPO.

In that context, it is pretty clear that a lot of the growth and value that was once captured by public investors (including you and I as retail investors), is now being captured by the late stage growth and cross-over investors, while increasing the risk/return profile of Unicorns in the public market once their valuation has been “maxed out” in the private market.

VC firms are flushed with $75Bn of dry powder

so you can bet they will want to party on!

I remember ringing the bell at the NYSE in 2009 with my startup InsideVenture, for the launch of our new product, dubbed “HPPO” for Hybrid Public Private Offering. At the time, VC-backed IPOs and Wall Street in general had ground to a halt after Bear Stearns and Lehman went down. We talked about ways to fix the IPO market and “orderly transition” of the cap table with top VCs such as Ray Rothrock from Venrock and Scott Sandell from NEA.

Ringing the Bell in 2009 at the NYSE for our Product Launch:

HPPO – Hybrid Private Public Offering

With new regulations such as Reg A+, allowing private companies to crowdfund up to $50M and trade their shares on secondary markets, it looks like the future might be just that, a world where public investors are finding their way back into ventures, earlier in the growth curve!

As Bill Gross told us last Thursday, “Timing is everything”…we were just 7 years too early!