The Rise of Angel(List) and how it is rapidly changing the game of angel investing

Disclosure: BootstrapLabs invested in AngelList, see our profile here.

The cost of building technology companies over the past decade has decreased by a factor of ten. Software has been eating the world, yielding incredible productivity gains that empower entrepreneurs to execute two to five times faster. Globalization, standardization and connectivity have all been driving unprecedented scalability, allowing a small group of people to reach millions, across the globe.

In a world where it takes less capital to do more, the winners are the entrepreneurs – as they can hold on to more of their companies (especially early on) – and angel investors – whose smaller checks when combined with many others, represent a significant enabler for early stage companies.

Regulatory changes allows new investors

The Job Act of 2012 dramatically broadened the definition of who could invest in private companies as long as they invested within certain boundaries and through registered broker-dealers. Equity crowdfunding and the technology platforms that support them became a hot topic of conversation (and still is). In effect, the rank of potential angel investors had just been multiplied to accommodate a flood of new, mostly inexperienced aspiring angel investors. As players started to jockey for position, two camps formed on the platform side. The ones that were or sought to become registered broker-dealers in order to leverage the new regulation and capture upfront success fees, and the ones, like AngelList, that decided to forgo the short term focused success fee model and instead share the risks and rewards with fellow investors by capturing a small share of the profits (a.k.a. carry), if any.

AngelList is born

AngelList was started by Babak Nivi and Naval Ravikant, first as Venture Hacks, a blogging website bringing the startup community together and aiming at increasing the transparency of the VC world. After crawling under the avalanche of requests from entrepreneurs to connect them with angel investors, Naval suggested to “simply list them online”. AngelList was born. (Image: AngelList co-founder, Naval Ravikant)

AngelList was started by Babak Nivi and Naval Ravikant, first as Venture Hacks, a blogging website bringing the startup community together and aiming at increasing the transparency of the VC world. After crawling under the avalanche of requests from entrepreneurs to connect them with angel investors, Naval suggested to “simply list them online”. AngelList was born. (Image: AngelList co-founder, Naval Ravikant)

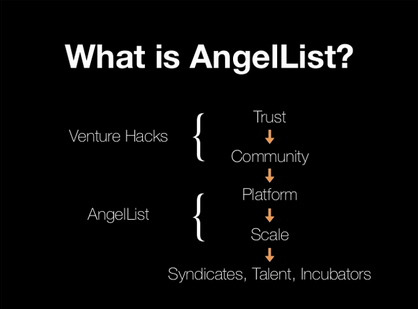

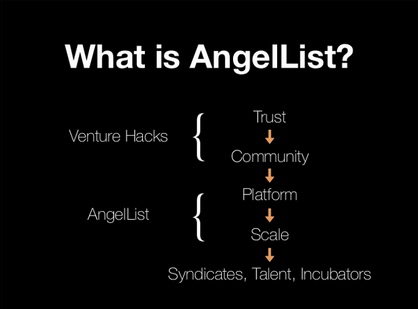

What is AngelList?

AngelList is designed to make capital raising less taxing and more flexible for entrepreneurs, and at the same time more efficient, transparent and scalable for angel investors. One of the unique and disruptive element of AngelList is its Syndication Business Model, launched in the fall of 2013. Instead of registering with FINRA / SIPC as a broker-dealer in order to charge commissions, AngelList sought and received a No Action Letter from the SEC to deploy its disruptive syndication model.

How AngelList delivers value to all players

AngelList’s technology platform delivers value to all players involved; founders, backers and angels.

Benefits for Founders

- Reach many angels with one online profile; build a following.

- Amplify noise signal with each progress, milestones, commitment.

- Convince one top angel and have many more chip in via their syndicate with no extra effort.

- Syndicate backers (up to 95) become potential “fan” and can help you and your startup succeed.

- All the backers are lumped into a single LLC, managed by the Lead Angel and AngelList, which keeps the capitalization table simple.

Benefits for “Backers”

High profile angels usually build a group of “backers” – fellow angel investors – for their syndicate so that they can easily share investment opportunities with them and receive carry in exchange for providing them access, vetting and post investment value-add to increase success/outcome.

High profile angels usually build a group of “backers” – fellow angel investors – for their syndicate so that they can easily share investment opportunities with them and receive carry in exchange for providing them access, vetting and post investment value-add to increase success/outcome.

- Backers can rely on experienced and reputable angel investors to discover, vet and invest in quality opportunities they would otherwise never see.

- Backers get to cherry-pick the deals they are investing in and build their own portfolio allocation.

- Backers are aligned with the syndicate lead who is also investing and risking its own capital.

- Backers are not charged upfront fees but pay a share of their future profit (“carry”), if any.

Benefits for Syndicate Leads

- High profile angels can share investment opportunities with a group of “backers” (definition above). In exchange the angels receive carry.

- Syndicate Leads don’t have to manage funds or go raise a fund with institutional investors that are usually slow and for which smaller investments or funds do not make sense.

- Syndicate Leads can increase their appeal to founders by being in a position to invest larger amounts and provide more value-add to their portfolio companies by leverage their Backers.

- Syndicate Leads can rank backers and ultimately curate their syndicate members based on value-add, investment patterns, etc.

- Deal per deal carry is yielding better returns for the syndicate leads than if they were running a traditional VC fund with equivalent carry terms.

Top Syndicates on AngelList

These top angels have formed Syndicates that are potentially capable of funding startups to the tunes of several million dollars, elevating themselves to the ranks of Super Angels or Micro-VCs. In this context, strength definitely comes in numbers and the trends are in favor of platforms like AngelList that are leveraging technology to deliver values to all players involved; startups, angels and backers.

What have the VCs been doing in the mean time?

Interestingly, in this very fast changing landscape, the venture industry and its economic model have seldom changed, with General Partners raising money for 10 years from institutional investors, charging 2%+ annual management fees and 20% carry after repaying the LPs’ principal. The funds usually get invested within 3-4 years and the General Partners then seek to raise another fund, hopefully on the early successes of the prior vintage funds.

In another post, we will cover the disruption happening among the VC firms, how some are leveraging platforms such as AngelList and what the benefits are for the angel investors/backers. Stay tuned and as always, stay foolish!