AI is going to change everything

/in AI, Blog, BootstrapLabs /by Nicolai WadstromWe are on the brink of a major disruption, which we think might be bigger than the industrial revolution. At BootstrapLabs we are focusing heavily on a major shift that is impacting almost every sector: Artificial Intelligence – AI.

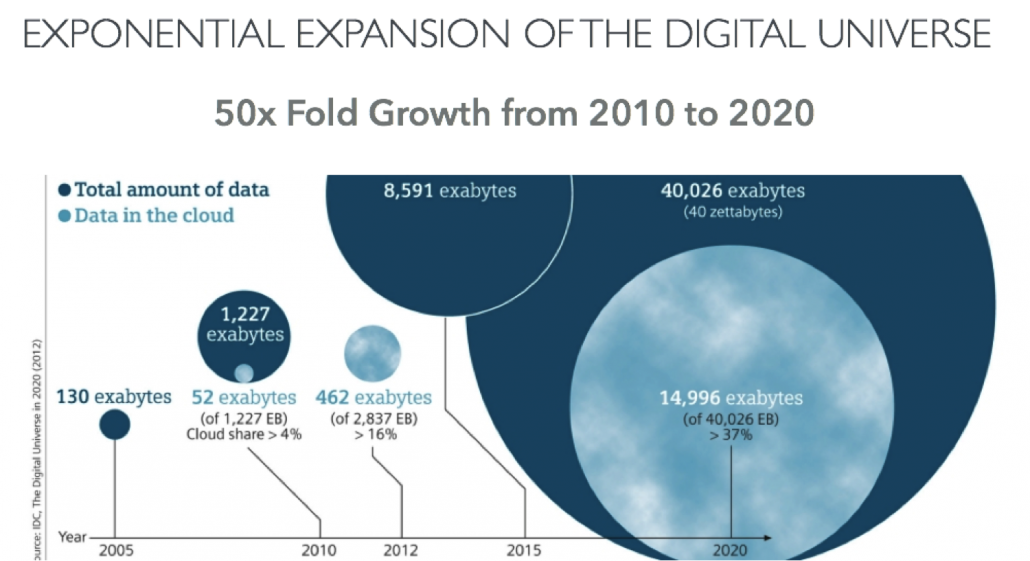

AI has reached an inflection point, where it can now be applied to quickly drive efficient returns, and in our book, is ripe for building startups that will disrupt major markets and their incumbents.

Why now?

Let’s go back: The Industrial Revolution & Apple

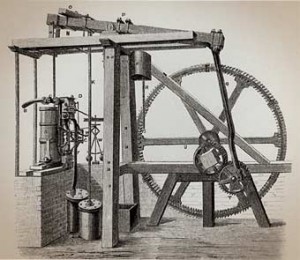

During the Industrial Revolution, the steam engine enabled a major technological shift as a large amount of manual labor was now able to be automated. Yet, few know that the first version of the steam engine was actually built the 1st century CE and was called Aeolipile. It was not until much later, in 1712, when Thomas Newcomen developed a commercially viable version of the steam engine that applied to “mechanical work” that serious increases in productivity started to take place. But, this major shift did not reach its full disruptive potential until 1781 when James Watt designed a model that provided a stronger and continuous rotary motion, resulting in an order of magnitude better output/cost ratio and allowed the technology to spread across applications and sectors, spurring the Industrial Revolution.

During the Industrial Revolution, the steam engine enabled a major technological shift as a large amount of manual labor was now able to be automated. Yet, few know that the first version of the steam engine was actually built the 1st century CE and was called Aeolipile. It was not until much later, in 1712, when Thomas Newcomen developed a commercially viable version of the steam engine that applied to “mechanical work” that serious increases in productivity started to take place. But, this major shift did not reach its full disruptive potential until 1781 when James Watt designed a model that provided a stronger and continuous rotary motion, resulting in an order of magnitude better output/cost ratio and allowed the technology to spread across applications and sectors, spurring the Industrial Revolution.

As always with technology and its applications, it is a combination of factors that create an inflection point.

The Garages of Silicon Valley: A similar pattern and iterative process emerged in the garages of Silicon Valley, and eventually spawned the likes of Apple, Hewlett Packard, etc. This is a recurring pattern of how innovation emerges. The inflection point is always triggered by a number of factors, not just the main innovation of the steam engine or the silicon-based CPU chips (or COTS components to build a computers for that matter).

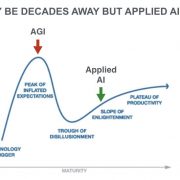

The Rear-Mirror Effect: These inflection points are often hard to spot. First there is disbelief, then some excitement. Then the general public tends to be disappointed by the slow(er) pace of adoption vs. their expectations, yet slowly but surely, additional improvements and iterations of the original breakthrough take place, quietly, unnoticed. Even additional breakthroughs building on the prior ones create an unstoppable wave of change that often catches people by surprise and most realize that the inflection point really happened a few year ago, when looking in the rear-mirror (and they are too late to the game).

The rise of Applied Artificial Intelligence (Applied AI)

Today we have reached a similar inflection point with Applied AI and we believe it will have a significant disruption potential on many established industries, and our society at large. Today smart software can process massive amounts of data to derive knowledge and conclusions that humans simply cannot.

AI methods and algorithms are not new, they have been around for quite some time, but there are a number of factors that are creating an inflection point for AI to be applied in a much wider sense, across applications and industry verticals that were not feasible before. Additionally, more recent approaches and methodologies like deep learning have yielded an order of magnitude better results than prior approaches.

Ability to compute, store and transfer data

- We are buying twice the amount of CPU processing for each $1 every 18 months.

- We are buying twice the amount of storage for each $1 every 12 months.

- We are buying twice the amount of communications bandwidth for each $1 every 9 months.

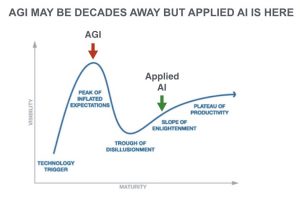

More data recorded in last 18 months than the entire history of mankind

The vast majority of all information ever created by mankind was created, transferred, and stored in the past 18 months alone. There is a massive amount of data (and knowledge/information to be extracted from it), and it is growing exponentially.

Multi-dimensional correlations

Also multi-dimensional correlations add a massive opportunity. Take for example fitness trackers, such as JawBone and FitBit, that are tracking activities like movement and sleep. In just a few years they harvested more research data and conclusions (using machine learning) of how physical exercise and sleep are tied together than any research facility ever had in history (and at a fraction of the cost).

Oh – and they also track where (geographic position) exercise is happening, which adds another dimension to this information.

In another example, one of our portfolio founders is exploring how to connect your emotional state of being with what you read in your social communications channels, event calendar, etc., and have the machine learn and guide you on ways to improve your mental well being.

Cost to build keeps going down

The cost to build startups keeps going down, which is true for building AI at scale too, through hosted infrastructure, cost of hardware and open source software (backed by Google, Facebook, Yahoo!, OpenAI, etc.) AI is being applied right now in garages around the world where startups are being built. The hardware needed today is so commoditized that it is all more or less a software play (which increases the pace of innovation and efficiencies).

This all means that innovation by applying Artificial Intelligence is exploding and happening everywhere, not just in the large R&D labs and research facilities anymore.

It holds the keys to our future

All this data, that can now be stored and computed cost efficiently using smart software (AI), holds answers to everything from optimizing your retirement savings, global economic flux, health, education, and answers of how to mitigate climate change today and tomorrow.

The most exciting things are yet to come, but let me give you a few examples of what is already happening:

- AngelList uses massive amounts of data and interaction patterns with machine learning to improve matching and interaction in their global network of Angel investors.

- 23andMe uses machine learning and big data to find, in 20 minutes of compute time, the answers that took the CDC up to 7 years and a $100M study to accomplish.

- George Hotz, the San Francisco “hacker” known for being the first to unlock the iPhone, has built a self-driving car in a month, using mostly off the shelf components, and using deep learning methodologies, resulting in potential self-installation kits costing less than $1,000 a pop.

- JawBone has conducted the biggest sleep study in history (no company or research organization has had access to that much sleep data before).

As with building any startup today, the hardest thing is Scalable Product Market Fit, which is also why it is so hard for incumbents to tackle the innovation that comes out of startups (Innovators Dilemma).

The large and well funded R&D organizations are still good at cracking hard innovation with long time frames, often called “Moon Shots”, but much less so for finding new Scalable Product Market Fit. This is where startup innovation shines, and when the off the shelf components can be assembled quickly, innovation flourishes.

There is an unbundling of the big corporations, and we think that the key disruption driver for the winners is going to be their ability to apply Artificial Intelligence, and build better, more efficient products that scale.

So what are we doing about it at BootstrapLabs?

We are, of course, focusing our entire Venture Building platform toward the discovery of the best Applied AI innovation globally, and empowering the founders behind them to build globally disruptive companies from Silicon Valley.

We are vetting over a thousand startups per a year from Silicon Valley, Europe, and Asia, and are seeing some very exciting innovators (which you will read more about soon!) who are applying AI such as machine learning, image recognition, and deep learning.

Our upcoming seed fund will invest in Applied AI software startups with a focus on FinTech, IoT, and Future of Work verticals (with the ability to expand into areas like logistic, education, commerce, eHealth, etc.)

We are also bringing together the global AI community of hackers and builders at hackers.ai and hosting the biggest Applied AI focused conference in Silicon Valley on May 25th.

Learn more about the Applied AI Conference 2017.

BootstrapLabs: Venture Builders in Silicon Valley with a Global Community

/in Blog, BootstrapLabs /by Benjamin LevyWhen we founded BootstrapLabs eight years ago, we set out to create a company that would empower some of the world’s best technology entrepreneurs to build disruptive companies from Silicon Valley.

In our quest to build an efficient and scalable process to empower entrepreneurs, we transformed BootstrapLabs into a world class Venture Builder platform and brought together 3 critical elements for the success of any entrepreneurial endeavor:

- Human Capital: Beyond access to our Core team, Global Venture Partners, and Experts in Residence, we have created BootstrapWorks, a proprietary platform that allows founders to find, vet, and compensate top advisors and experts in Silicon Valley and beyond, while removing the friction of contracts, vetting, etc.

- Venture Capital: Because entrepreneurs need fuel to accelerate the growth of their ventures, we invest in our portfolio companies from our investment funds at the Seed and early Series A round stages. We have also built a great network of top-tier Silicon Valley co-investors and follow-on investors for our companies.

- Global Community: Over the years, we have nurtured and grown a large and international community of like-minded entrepreneurs, investors, and executives that further reinforce our platform and deal flow.

BootstrapLabs recognizes that talented entrepreneurs have many choices when it comes to accessing capital, but money is only the tip of the iceberg. Experienced founders know that the human capital part of the equation is often the difference between breakout success and failure. For this reason, we strive to provide founders with a bespoke combination of capital, skills, experience, and network, a place were the world’s best founders WANT to come build and iterate their startups to scalable product market fit and success.

If this sounds exciting, get in touch, and come make a dent in the Universe with us.

What most people don’t know about being a startup CEO/founder

/in Blog, BootstrapLabs, Insights /by Nicolai WadstromTechblogs tend to paint a glamorous picture of how easy it is to raise a billion dollars in funding and build a startup. Reality is very different – it is hard work, a long journey and compared to a job, you are never really off the job.

As a startup founder for 20+ years and counting, 10 years as an angel investor, and lately a Venture Capital investor through BootstrapLabs, I have seen a number of interesting patterns in startup founder’s/CEO’s behavior.

One thing I think a fair bit about is the ‘obsessive’ behavior of successful founders that I advised and invested in for the past 10 years (and I see this trait in myself as well…).

Startup CEOs are working super hard, and not always at the office. They always seem to be preoccupied, which drives spouses and family members crazy sometimes.

It’s not that they are literally working 90+ hours a week in an office, doing work tasks such as coding, recruiting, selling, etc. Once they start to grow their team and begin getting traction, to be successful they need to shift into how to really drive the business. And they always need to be thinking about the next big thing, and how to get the company to the next level or stage of growth.

The reason for this is that startups are not really executing a business model, they are in search of a hyper scalable business model. And that search continues until they get escape velocity, die, or divest for other reasons.

So on the journey of a startup CEO you don’t have a quiet moment in your head most days, you are constantly thinking about your ‘baby’, and trying to figure out how to solve problems 24/7 around the clock 365 days a week (or sorry, I mean per year).

As I tell many founders that pitch us at BootstrapLabs, you need to surround yourself early on with a team that shares this ‘obsessive’ behavior to drive your startup forward. And your most important job is to find those people and make them excited about the being part of the journey.

So even when having dinner with friends, or taking care of the kids, or in the morning shower, the founder/CEO is thinking that to hit that $5 million annual run rate to raise the “A” round, you need to ramp up hiring of the sales force and marketing teams. And you need somebody that has experience in X and skills in Y. Or that a particular piece of the product is inhibiting the growth, or is not good enough to drive Product Market Fit, etc.

When launching a new startup: You usually start in a search & discovery mode – that seems to be all over the place for many of the people around you. But once you start to get data points and validation of what you do, you need to quickly shift into a very different approach that is laser focused. At the same time you need to stop every 2 weeks or so and question just about everything and make sure that your assumptions are still valid.

From early assumptions to Laser Focus: Once you have found what to zoom in on, your most scarce resource is actually neither money or time, but personal attention span – which is why most startup CEO’s go into a reductionist mode to create a clear focus on the most important things that need to happen to bring the company to the next level. If you focus on the right things at the wrong time, your company dies.

This is why there are a few key things you need to learn early on as a founder/CEO of a startup:

- You need to recruit co-founders and team members that give you leverage (execute things independently better than you) – this will increase your attention to other things you do better.

- Early on and for the core team, you need to find people that share your obsession & passion.

- You need deep domain skills for the core things you are trying to do within the team, for everything else you need great advisors that can give you sharp insights a few times a month.

Because of the shift from discovery to reductionist mode, the early team is extra hard to build, as very few people are capable of shifting successfully between these two operating modes. In part, this is why it is so hard to find co-founders, since this prerequisite skill is so scarce.

After you have found a focus it becomes a tad easier, but you still need to build a core team with an almost obsessive drive to take things to the next level, and then work really really hard to become a Unicorn.

“No sleep for the wicked”

Venture Capital Industry: At the Dawn of a New Era

/in AngelList, Blog, BootstrapLabs, EIR, Insights, Silicon Valley, Unicorn, Venture Capital /by Luigi Congedo2015 has been a banner year for BootstrapLabs. During the past 12 months, we led our first Series A round in an exciting FinTech company, all our portfolio companies raised follow-on funding at higher valuation and we continued to expand our Expert in Residence team to support our portfolio companies.

We believe that technology is a driving force for positive change in the global economy, in society in general, and our daily lives in particular. We continue to be impressed by the talent and passion our founders demonstrate every day and look forward to continuing investing in disruptive technology companies that can transform the way we live, the way we work, and the way we connect with the world around us.

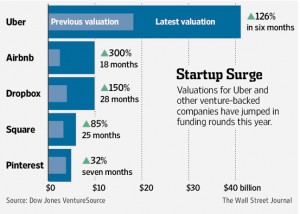

Many believe private companies are overvalued, while others think the next tech bubble is coming. At the same time we see that seed stage investments, where BootstrapLabs focuses, are more vibrant and exciting than ever (e.g., a $25K seed stage investment in Uber would be worth ~ $125M at the $40B valuation mark; even if you assume that Uber is worth $1B, it would still be an investment worth ~ $3M, or 125x the invested amount).

BootstrapLabs is “deep in the stack” alongside its founders day after day, driving the venture market momentum forward. Our global innovation discovery network, combined with our Silicon Valley investment and execution model, provides us with a unique vantage point on what is happening in every corner of the world. Here is what we are observing:

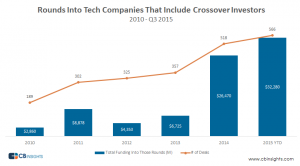

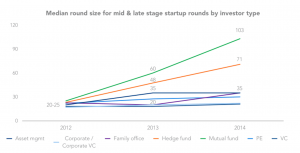

The HOT tech industry is attracting new, mostly late stage, institutional investors that need to invest tens of millions per deal to move the needle.

In 2015, over 566 deals were financed by investment banks, mutual funds, hedge funds, asset managers, and others, while 78% of the deals over $1 Billion have been lead (read priced) by non-VC investors.

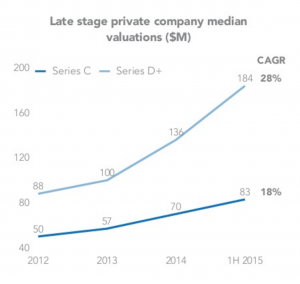

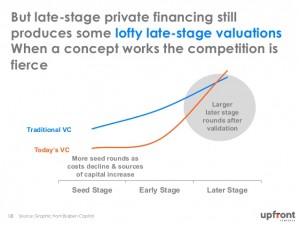

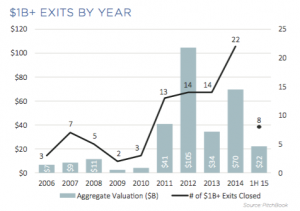

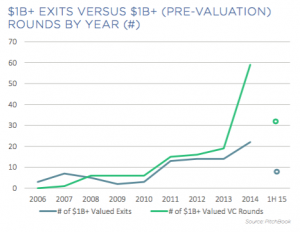

Late stage deals are becoming more competitive and less price sensitive due to a combination of i) pent-up demand driven by lower public market returns and the relative rarity of such high growth private technology companies and ii) more financial engineering and deal structuring that aims at lowering the risk for investors, independent of valuation paid (e.g. preferences, ratchets, dividends, etc.) Arguably, these higher valuations are behaving more like “out-of-the-money strike prices” of call options rather than rational valuations driven by operational and technological performance. The chart below outline the dramatic increase in valuation in the later stage as well as the larger amount of money invested by these non-VC investors.

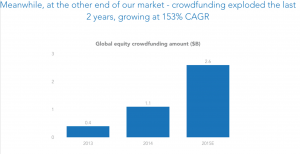

There are also NEW sources of capital targeting the Tech Industry via Equity Crowdfunding and platforms that are driving retail investors into the venture market.

As these platform emerge and private companies can do “public offering of private equity”, secondary market for private equity trading/exchange will gain momentum and importance. One big signal of such trend was the recent acquisition of SecondMarket, the leader in the space by Nasdaq.

Why are non-VCs investing in the tech space?

Startups are staying private longer prior to IPOs today, which means that private investors are making the most of the value from their investment during the pre-IPO period. Traditional public investors, like hedge funds and mutual funds, are starting to realize that in order to capture more value they have to move earlier in the game and start investing in pre-IPO rounds (Private IPOs). See this prior post from Ben Levy, Co-Founder of BootstrapLabs on How to Milk a Unicorn…

Also, traditional VCs have realized that they have to invest earlier in the cycle in order to maximize their investments and not become irrelevant themselves in a world that is changing fast.

Value is Captured Earlier

Because it takes a lot less capital and people to build a proven and scalable product/model, early stage investment has become the most important and possibly the most lucrative part of the value creation chain in our opinion.

Later, Access is King

Late stage investors will only succeed if i) they can identify outliers early and ii) they can win a seat at the table during the next fundraising round (hint: money is not enough)

These structural changes, combined with deregulation, have created a once in a lifetime opportunity to form and scale new ventures, as well as new VC firms to finance them. As shown by this recent research report published by Cambridge Associate, more than ever before in the history of the Venture Capital industry, newly formed VC firms have been able to invest and capture some of the top performing startups.

Yet, the opportunities for individual investors remains limited as the industry is shifting to a new model/structure. Similar to the situation with established VCs and hot startups, an individual investor better gain access to future hot new VC funds/managers now, because the best performing funds will have limited access for existing LPs and possibly no access for non-existing LPs in their future funds.

Quality vs Quantity

The number of startups created each year has exploded and will continue to grow quickly as the cost of building technology companies has decreased by at least 10x in the last 20 years, and success stories continue to be blasted across the media as a source of inspiration and validation. The problem will be to identify the good startups as the noise level continues to rise.

Early stage growth no longer signals long term success and the ability to iterate, build and improve your product has become one of the most valuable success skills in the tech space. At BootstrapLabs we excel at finding top talent, bringing them to the best ecosystem (Silicon Valley) and supporting them in their full-cycle “build-measure-learn” iterations.

Innovation is a constant requirement for corporations to remain relevant and it is a pillar of subsistence for our society. Tech innovation will continue to grow and generate outlier returns for the best VCs (and their investors) in the industry. As someone recently mentioned to us “VC is at a dawn of a new era”. Just look at these numbers:

- 3.6 Billion unique mobile subscribers in 2014

- 2+ Billion people connected on major social media networks (1.4B FB, 250M TW, 300M LNKD, 300M Instagram)

- 120x faster online speed (6.7 Mbps US average today)

- 243 million machine-to-machine connections

- 50 Billion connected devices by 2020

- $1.7 Trillion e-commerce spend

The total of all the Unicorn valuations today is worth about half the value of Apple. Some of them will go public, some will be acquired. Apple could actually acquire most of the Unicorns and still have billions in its bank account to spare.

The slow growth in the number of IPOs is a consequence of a historical switch and the growing importance of innovation. Companies need to invest most of their cash flow in innovation, while public market investors expect short term revenue first. Many startups are building for long term success, and if they go public too early they will be unable to maximize their innovation or opportunity. As Marc Andreessen said during a recent interview: “It’s not a tech bubble, it`s a tech bust”… many of the innovation and technology companies are still undervalued and we are strongly optimistic about the great future in front of us”. So is BootstrapLabs!

Behavioral Analytics: Just Keep It Simple

/in Blog, BootstrapLabs, EIR /by guestcontributorToday’s guest post is from Marianna Yanike Graf.

Behavioral Analytics

Summary: Behavioral analytics is the process of systematically sorting through data to uncover patterns of user behavior in order to gain an insight into user decision making. The better you understand your user, the better your company is at catering to your user’s needs and at anticipating them. So, how do you make sense of human behavior? Just keep it simple.

Know Your User to Optimize the Present and Shape the Future

Behavioral analytics deals with understanding patterns of user behavior. Nowadays we have access to a wealth of human data. Computing resources allow us to sort through it in a systematic way in order to gain understanding of human behavior. Any company, large or small, wants to use this knowledge to deliver the most optimal interactions with its users and make meaningful predictions about the future.

Of course, what is considered optimal is unique to each company. Optimal is often equated to individualized. If you know your user, you can do many things to tailor your products or services to this user. For example, you can optimize the design of your website to deliver the most relevant and timely information to your user (e.g. Amazon shopping card or Google Ads). Ultimately, though, you want to be proactive at communicating with your user. You want to predict, for example, when a next marketing campaign will be the most effective. You want to stop guessing and start making informed decisions.

The accuracy of such decisions will depend greatly on how well you lay out the process starting from collecting data, analyzing them and eventually drawing conclusions from them. For rapidly growing businesses operating in an ever-changing environment, this can be a challenging task. How do you make predictions? How far into the future? Also, human behavior tends to be irrational in general. Often our behavior is not driven by logic alone. So how do you analyze complex beings in an ever-changing environment? By keeping it simple. By asking specific questions, by finding simple answers and by doing it often.

Define Your Problem and Ask Specific Questions

When it comes to looking for answers, the most important part is formulating your question right. You can always find a data scientist to apply the most rigorous model to your data. However, if the question is ill posed, the answers will not be useful. Make sure you know what your users want, as opposed to what you think they want. For example, you want to figure out the best time to send out marketing updates to your users. Either you ask your users directly, or you test a few options by selecting a representative user subset and seeing how they react to the same updates sent out at different times. In other words, if you want to know X (best time for updates), change Y (time: beginning/end of the week; weekly/biweekly) and evaluate outcomes. Essentially, it’s about keeping it simple. First define a problem, then formulate a question and think of possible answers. Keeping it simple doesn’t mean that you have to ask only one question. Quite the contrary, try to formulate many specific questions and find simple solutions for each one of them.

Find a Simple Solution

Once you have formulated your problem, you need to decide the best way to address it. While it may seem like a logical approach, analyzing all data with a complicated model will not necessarily give you the most accurate answers. Why? Well, it’s like looking for a needle in a haystack. You are better off breaking down the haystack into many small ones and looking through each one individually. You are even better off if you can find the ones that are most likely to contain the needle. Big data are complex, capturing many dimensions and patterns, and yet often biased and incomplete. So overreliance on data analysis alone can produce complicated answers devoid of reality. Your logic and intuition are very useful for guiding you towards the simplest solution. For example, you want to create a new marketing campaign and tailor it to different users. Typically we think of demographics (e.g. age, gender, social platform preferences). But, you can also think about the timeline of how you have acquired those users (e.g. cohort analysis).

Do it Often

Probably the most important reason to use behavioral analytics in the first place is to make informed decisions about the future. Predicting the future, though, is challenging because all we can do is look into the past. Nowadays businesses operate in a fast paced environment and the dynamics of user interaction and/or needs can evolve or shift rapidly. When it comes to making predictions under such conditions, doing it often (frequently) is a reasonable approach. Why? Many models tend to train themselves on data to extract trends and make future projections. To accommodate for the fast dynamics of your business, you constantly go through a cycle of formulating a problem, collecting data, and making an informed decision to resolve it. Every time a change is implemented, user behavioral patterns can change too and the data become biased by the change. That is why time is an important factor. The dynamics of your business operations will determine how often you should forecast.

Marianna Yanike Graf is a research scientist with strong interest in behavioral analytics.

In addition, Marianna is also a brain decoder, data-artist, art-constructor and an Expert In Residence @ BootstrapLabs.

The ideal team: look for integrity, energy and intelligence

/in Blog, BootstrapLabs /by guestcontributorToday’s guest post is from Marten Mickos.

The most unlikely teams may soar to the most amazing success. For that reason, it’s not easy to define the ideal startup team. Here is what can be seen over and over again in successful teams:

- Each member of a winning team puts the success of the enterprise above the success of themselves.

- They have shared values and divergent opinions. They learn and adapt as a team.

- Everyone is passionate about customers. Each member of the team is focused on making the company’s customers successful.

- The entire team loves strategy development. Everyone engages in discussions about vision, purpose, strategy and also short-term goals.

From the passion for customers (#3) and the passion for strategy (#4) comes the ability to develop the value proposition, the product and market fit and a useful business model – things a startup must get right in order to start scaling. - At least some but rarely all are strong leaders with an ability to hire, inspire and retain great talent.

- Everyone and everything is action oriented. Stuff gets done. Everyone in the team knows that the five points above are worth nothing unless accompanied by execution. The execution is quick and precise.

When you are building a team, look for integrity, energy and intelligence, in that order. Those three characteristics are the foundation of success. Only people with high integrity will put the success of the enterprise above the success of themselves. Only people with high integrity can make teams with divergent opinions productive. Without energy things happen too slowly, and quality deteriorates. Worse, low energy is a predicament that negatively affects the surrounding team. Treat the word “intelligence” here in the broadest meaning: presence of useful skills combined with an ability to quickly learn more.

Within the scope of integrity, energy and intelligence, hire for strength. This means that you should look for people with the particular strengths that the team needs, and then make those strengths productive. You can always work around the weaknesses, and you must do so as everyone has weaknesses. Don’t try to hire “well-rounded” people with few weaknesses, because then you will get few strengths. Look for strength. Look for that unique talent that will make a huge difference for your company, and be prepared to then manage around everything else. But although you will tolerate weaknesses, never tolerate deviation from the core values of the organization. A weakness in a particular skill is a tactical problem that can be solved. A weakness that shows up as a deviation from the organization’s core values is not fixable. Do not hire people who do not subscribe to the values of the organization.

Be aware of the “non-vital positives”. Most people have a set of strengths and accomplishments that look and are good, but are not vital for success. Having attended a top-rated university or worked for a famous company is such an example. Nothing wrong with that, but in itself it proves little. Being well spoken is another. It’s a useful skill, but it’s not among the top 10 requirements. Knowing the same people or being member of the same club is another example. Nothing wrong with it, but it is not a defining characteristic. You should just hire for the specific strengths that you know the company needs.

Finding the right mix of culture and values is difficult. On the one hand, there must be shared values in the team. On the other hand, diversity and divergence in opinions is absolutely vital for sustained success. Don’t hire people who are like you or think like you. Hire people who are unlike you, but who share the few core values that you have stated as the cultural foundation of the company.

Hiring the people is just the first step in building a world-class team. After hiring, you start making the strength you hired productive. The best guidance on this can be found in Peter Drucker’s book the Effective Executive, in the Making Strength Productive chapter:

“The effective executive makes strength productive. He knows that one cannot build on weakness. To achieve results, one has to use all the available strengths—the strengths of associates, the strengths of the superior, and one’s own strengths. These strengths are the true opportunities. To make strength productive is the unique purpose of organization. It cannot, of course, overcome the weaknesses with which each of us is abundantly endowed. But it can make them irrelevant. Its task is to use the strength of each man as a building block for joint performance.”

As you build the ideal team, don’t lose sight of building yourself. No one is ready – ever. We have to keep managing and developing ourselves. We may think that we cause change in the organization by changing others. It is true that we can influence others. But the real source of change is within ourselves. If you want to make a change in the team or the broader organization, start with yourself. Set the bar high for your own development and improvement. But also be patient with the outcome and remember to appreciate and support yourself as you evolve. Focus on your own strengths, and ask your team to help you manage around your weaknesses.

An ideal team is a rare occurrence. When it happens, it is the crowning of all your efforts as the leader. When a good team becomes a great team, the whole company rises to a new level of performance. Everyone knows that you can accomplish anything together. It is a feeling of enormity.

This post was originally published at School of Herring.

Marten Mickos | @martenmickos

Marten Mickos | @martenmickos

Marten Mickos is a Silicon Valley entrepreneur and business leader. The knowledge he shares has been gathered first-hand through his various experiences of utter failure and smashing success. As the CEO of MySQL he pioneered open source software and built a company worth a billion dollars. At Eucalyptus he recovered strongly from near-fatal hardship. As SVP at Sun Microsystems and Hewlett-Packard he has experienced leadership at the largest scale. He is a Silicon Valley Finn passionate about leadership and disruptive businesses in an open and distributed world.

Oracle Inspiration Tour 2015: a morning with BootstrapLabs

/in Blog, BootstrapLabs, Event, Silicon Valley, Unicorn, Venture Capital /by BootstrapLabsAs part of Oracle OpenWorld 2015 this week, Oracle France organized a 5 day “inspiration” tour of San Francisco/Silicon Valley for about 30 French corporate executives. After visiting some of our friends at LinkedIn, Lending Club, and Uber, the group spent Tuesday morning with BootstrapLabs at our San Francisco offices.

Settled in with coffee and pastries, the group met with Ben Levy, BootstrapLabs co-founder, who spoke of his journey as an entrepreneur, our work at BootstrapLabs, and the economic impact of venture capital, and the unique role that Silicon Valley plays in terms of innovation, disruption and growth.

Settled in with coffee and pastries, the group met with Ben Levy, BootstrapLabs co-founder, who spoke of his journey as an entrepreneur, our work at BootstrapLabs, and the economic impact of venture capital, and the unique role that Silicon Valley plays in terms of innovation, disruption and growth.

The executives from Alcatel-Lucent, Kering, Lafarge, Ubisoft, Société General, and other top French firms, had plenty of questions about how the changes we see here in Silicon Valley will affect the large corporations they run, with concerns about mobile apps, SaaS, financial systems and customer relations leading the way. Ben shared some facts and figures, as well as concrete examples of why collaborating, innovating and adapting to the changes that we see firsthand here in Silicon Valley are crucial to global companies.

The executives from Alcatel-Lucent, Kering, Lafarge, Ubisoft, Société General, and other top French firms, had plenty of questions about how the changes we see here in Silicon Valley will affect the large corporations they run, with concerns about mobile apps, SaaS, financial systems and customer relations leading the way. Ben shared some facts and figures, as well as concrete examples of why collaborating, innovating and adapting to the changes that we see firsthand here in Silicon Valley are crucial to global companies.

As the event concluded with presentations from five startups that are working in the areas of transit, retail, collaboration, marketing, and sales, our visitors left to continue their tour and gather more inspiration.

AngelList: The World’s First On Demand VC-as-a-Service Platform

/in AngelList, beGLOBAL, Blog, BootstrapLabs, Event, Investor /by Benjamin Levy[Disclaimer: BootstrapLabs is an investor in AngelList and we have two syndicates, BootstrapLabs Syndicate and BootstrapLabs A+ Syndicate with Gil Penchina]

Last week I had the good fortune to find myself interviewing Kevin Laws, the COO of AngelList just a few days after they had launched a series of announcements that sent tremors through the entire startup and venture investment ecosystems:

- Launched CSC Upshot: a new $400M seed fund dedicated mostly to early stage startups and syndicated deals on AngelList; which comes in addition to the existing Maiden Lane’s $25M fund launched in April 2014

- Opened-up its backend infrastructure to offer “SPV as a Service” for angels and VCs interested in capturing pro-rata and/or additional carry on their best deals, across stages

- Pushed its iOS App for its “joblist” marketplace

First of all, let’s briefly cover what came out of my fireside chat:

- AngelList is trying hard to stay in love with the problem they set out to solve when they first launched: “How do we help founders (globally) focus on what matters most, which is building their company and products, and spend less time fundraising?” You can sense that they have made this problem a core value at AngelList.

- We argued that cross-border angel investing would not be possible without online platforms like AngelList, bringing both sides together (founders and angels), yet maybe more importantly without a trust & expertise based syndication model that aligns everyone’s interest, removes significant friction in the decision process (“emotional friction”) and ultimately building technology and processes to close the transactions (“physical friction”). Among the new stats shared by Kevin during our talk, he said that 10% of the capital invested online on AngelList was from outside Silicon Valley, while only 3% of completed fundraising online was for companies outside of the US. The new fund will definitely give a huge boost to the foreign capital percentage number above, unless they classify it as a US fund, event though it is backed 100% by Chinese capital.

- Kevin placed the number of startups on AngelList at approximately 300,000 with 30,000 or 10% of them being in fundraising mode at any one time. In one sense, the odds of being “discovered” on AngelList are much better than they were in the Apple Store as of June 2015. There were over 1.5M apps, but the syndication of your round by a well known angel investor in Silicon Valley remains your best shot to stand out (kind of your equivalent to being featured by “Apple” in the store). The interesting bit for me was that this was still holding true for foreign companies trying to fundraise on AngelList. Kevin used the example of Descomplica, a Brazilian online education startup that raised $5M in February 2014 from Social+Capital, and used a syndicate led by my friend Lee Jacobs, a local angel investor with ties to Brazil, to ignite the fundraising on AngelList. Lee was also the very first to do a syndicate on AngelList so he gets pioneers’ points in my book :). Kevin also makes a very important point on the video below…you can invest anywhere but you might not be able to get your money back everywhere! Let us not forget that over 80% of technology M&A deals happen in Silicon Valley (buyer or seller is located there) and the last time I checked, corporate sales were responsible for 95% of the return of capital for VCs.

You can find a “meerkat” version of the interview here for now and I will upload a professional version from beGlobal as soon as it becomes available.

Now on with my two cents on their recent announcements:

CSC UPSHOT FUND

Some dubbed it the world’s largest seed fund and it sure is an impressive amount, but read the fine print. You realize that the investment thesis is broader…you are talking about investing in top startups (based on their metrics and syndicate leads) not just in Silicon Valley, but globally with the ability to do pro-rata and access later stage opportunities too (which are now facilitated even further due to their new SPV product). As I mentioned on stage, it takes a “Chinese billionaire” to have the humility to say “I do not have access to Silicon Valley deal flow, nor may I have the skills to vet it, but I sure can get some of the smartest people in the business to discover, vet, and syndicate some of their best deals for me, as well as secure access to follow-on funding via pro-rata rights and SPVs.” I am convinced that many institutions and family offices that invest in venture have been asking themselves why they did not think of it before, how maybe they just needed a lead to follow.

FREE ONLINE SPVs FOR ANGELS & VCs SYNDICATING LATER STAGE ROUNDS

This part did not grab the headlines, but this is probably the submerged part of the iceberg in my own opinion. By opening up its backend infrastructure and making these online SPVs free for Angels and VCs ($10K admin fee is spread among the LPs and AngelList does not charge any carry), AngelList is getting 3 very significant benefits:

- they are getting all the LP contacts

- they are accelerating the growth of their funds under management, and

- last but not least, they are capturing performance and return data at the source

This is by far the most significant announcement AngelList made that day for the future of AngelList.

“JOBLIST” iOS APP

If fundraising is among the top pain point of founders, recruiting talent is probably way up there as well, so it is only natural that AngelList spends a significant amount of time and capital improving its job marketplace product. It will also over time become a very strong competitive advantage and barrier to entry as “startup” skills and know-how are in very high demand across the world. There is also a very natural and synergistic relationship between fundraising and hiring since most $ startups raise goes to hiring more talent!

At BootstrapLabs we ask all our portfolio companies to create and maintain an up to date AngelList profile as a way of communicating with their stakeholders, including future employees.

Thank you to Kevin and the team at beGlobal for providing me with the opportunity!

So long and happy investing.

Presentation used by AngelList for their PR announcement

About Ben Levy

Ben is the co-founder of BootstrapLabs, a Venture Investment Company that invests capital, experience, and skills into disruptive software companies from around the world, and helps their founders relocate to Silicon Valley to build BIG. Born in France and living in Silicon Valley for the past 17 years, Ben is a repeat entrepreneur who launched, built, and exited two startups in the financial technology space, one to Mergent, and another one to SecondMarket, who was recently acquired by NASDAQ.

Ben is the co-founder of BootstrapLabs, a Venture Investment Company that invests capital, experience, and skills into disruptive software companies from around the world, and helps their founders relocate to Silicon Valley to build BIG. Born in France and living in Silicon Valley for the past 17 years, Ben is a repeat entrepreneur who launched, built, and exited two startups in the financial technology space, one to Mergent, and another one to SecondMarket, who was recently acquired by NASDAQ.

He has also helped founders raise over $300M of capital from Venture Capitalists and Private Equity Investors and closed $5B worth of technology M&A transactions as an investment banker earlier in his career. He is a frequent speaker on innovation, investing, technology, entrepreneurship and globalization.

BootstrapLabs at Innovation Skåne – Advice for Swedish entrepreneurs

/in Blog, BootstrapLabs, Event, Nicolai Wadstrom, Silicon Valley, Sweden, Unicorn, Venture Capital /by BootstrapLabsLund, Sweden | Wednesday 21 October 2015

In a room full of entrepreneurs, BootstrapLabs founder Nicolai Wadström shared his thoughts on Silicon Valley unicorns, and the speculation of tech bubbles and overvalued startups. He reminded his audience to focus on value, and the fundamentals of the companies being touted as Unicorns.

Event with Connect Angel Network in Malmo at Minc: Unicorn Factory/Leveraging Silicon Valley

/in Blog, BootstrapLabs, Event /by BootstrapLabs![]() Nicolai Wadstrom, Founder and CEO of BootstrapLabs will share with Swedish entrepreneurs, local angels and the Connect Angel Network and Minc community his journey with BootstrapLabs.

Nicolai Wadstrom, Founder and CEO of BootstrapLabs will share with Swedish entrepreneurs, local angels and the Connect Angel Network and Minc community his journey with BootstrapLabs.

Attendees will also receive valuable insights and learn how companies like Prezi scale from a small office in Budapest to a 300+ people company in Silicon Valley.

Attendees will also receive valuable insights and learn how companies like Prezi scale from a small office in Budapest to a 300+ people company in Silicon Valley.

A guaranteed dose of inspiration will be provided to all the attendees!

Prezi Presentation from the Event

PICTURES FROM THE EVENT

SPEAKER

Nicolai Wadstrom, Founder & CEO of BootstrapLabs

Nicolai Wadstrom, Founder & CEO of BootstrapLabs

Nicolai Wadstrom, a serial entrepreneur turned parallell entrepreneur as the founder of BootstrapLabs, a Global Venture Capital firm based in Silicon Valley. Nicolai advises all portfolio startups in their day to day operations, connecting founders with industry experts, advisors and investors to increase their likelihood of success, assisting with product design and development, positioning, go-to-market strategy and implementation, partnerships and fundraising.

Multiple time Startup CEO, CTO. Raised capital from Angels, Private Equity, Investment Banks and VC’s. Angel investor and adviser to Internet, Software, Mobile and Digital Media startups in Europe and Silicon Valley, including BootstrapLabs portfolio companies such as Prezi, Zerply, Audiodraft and Witsbits. Nicolai has been writing code since he was 10 years old, and still speaks Java fluently. He is very focused on product and technology development within the Big Data, Analytics, Internet, Mobile and Software/Cloud sectors. Nicolai is a frequent guest speaker, mentor and judge at Universities and Conferences in the US and Europe.

Are You Ready To Build Your Start-Up Brand Early?

/in Blog, BootstrapLabs, Founder's Advice /by guestcontributorToday’s guest post is from Martin Roll.

I am often asked when entrepreneurs, start-ups and younger companies should start to build their brands. The implicit impression by those asking is that branding and brands are for later, not in the early stages. I could not disagree more. The earlier you start it, the better chances of scaling and globalizing your brands. People don’t buy products and services, they buy brands.

Building and sustaining brands are not a luxury for entrepreneurs and start-ups, it has become necessity in order to compete in a globalized world where brands play an important role in building strong market positions and driving value.

The emergence of global Asian brands and the bold aspirations by Asian leaders should serve as great inspiration for entrepreneurs and start-ups as illustrated in the following.

The rise of Asian global brands: From “nice to have” to “need to have”

An increasing number of Asian brands are becoming successful well beyond Asia. But with two-thirds of the global population, growing economies, a rapidly growing middle class with an increasing disposable income, Asia still boasts only a handful of powerful global brands which is a cause for concern, and a great untapped opportunity. But given the size and volume of Asian business today, it is evident that Asia could build many more prominent brands and capture more financial value from better trade power, price premiums, customer loyalty and other important metrics.

Building and sustaining brands are not a luxury for Asian firms any longer, it is a necessity in order to compete in a globalized world where brands play an important role in driving value.

Therefore, in an updated and revised edition of the bestselling book Asian Brand Strategy, I have provided a comprehensive framework for understanding Asian branding strategies and Asian brands, based on new research and supported throughout by a wealth of new case studies from several Asian countries.

Asian Brand Strategy provides insights, knowledge, and perspectives on Asian brands and branding as a strategic tool, and provides a comprehensive framework for understanding Asian branding strategies and Asian brands, including success stories and challenges for future growth and strengths.

Asian Brand Strategy includes theoretical frameworks and models and up-to-date case studies on Asian brands, and I believe it is a must-read for Asian and Western business leaders as well as anyone interested in the most exciting region of the world.

Will Asian companies challenge the global brands?

Several indications show rapid progression in the right direction for a selection of Asian companies where branding as a strategic tool has become more recognized and accepted in their boardrooms. This is also driven by the increasing attention on branding and its value-driving capability among stakeholders, media and opinion makers across Asia.

Asian companies can have great intentions and aspirations to move up the value-chain through branding to capture the financial and competitive benefits, but to achieve these objectives successfully, Asian companies must follow a comprehensive brand strategy framework supported by a systematic process throughout the organization.

Successful implementation of these processes will help Asian boardrooms to better compete in the global marketplace, and in achieving sustainable revenue and cash flow streams for the future.

In my book, I use the Asian Brand Leadership model to illustrate the paradigm shift that Asian brands need to undertake in order to unleash their potential:

First, mindsets and practices need to change in Asian boardrooms. Asian Brand Strategy invites a complete shift in the way that Asian boardrooms think of branding:

- From a tactical view to a long-term, strategic perspective

- From brands viewed primarily as advertising and promotion to brands as strategic assets

- From fragmented marketing activities to totally aligned branding activities linked to business strategy

- From a vision of branding as the sole responsibility of marketing managers to branding as the most essential function of the firm led by the CEO, CMO and board room

Second, this new perspective must be grounded in in-depth understanding of consumer behavior patterns. Asia is not a homogeneous entity. More importantly, Asian countries are more and more traversed by cultural flows permeating the region: cinema, music and fashion trends that at present extend beyond national borders to capture the imagination of millions. Branding and brands do not operate in a vacuum; they are closely linked to developments in society, to people and cultures.

Third, managers wanting to succeed in Asia need to abandon the oriental Asia of the past. Asian consumers are all vying for an Asian type of modernity that has nothing to do with colonial imagery.

Fourth, to create iconic brands, Asian managers will have to become trendsetters. The perspective developed in Asian Brand Strategy is that, in order to be successful, Asian brands need to capture the spirit of the region, and lead the way by creating that spirit.

Finally, this shift can be achieved only if everybody in the company is convinced of the power of branding. This, in turn, can only happen through accountability and systematic monitoring of branding investments and performance. Organizations that utilize data-driven decision-making are more productive and profitable than their competitors.

Martin Roll | @MartinRoll

Martin Roll | @MartinRoll

Martin Roll delivers the combined value of an experienced global business strategist, senior advisor and facilitator to Fortune 500 companies, Asian firms, family-owned businesses and start-ups on how to build and manage strong, global brands as well as leadership of high-performing, marketing-oriented businesses. He is very experienced in engaging and advising clients at all management levels from business owners and C-suite leaders to functional staff across multiple industries and cultures. Author of Asian Brand Strategy.

How to Milk a Unicorn… No Really, How?

/in Blog, BootstrapLabs /by Benjamin LevyVictoria Silchenko recently posted an article on LinkedIn, Confession of Venture Capitalists: How to milk a Unicorn where she interviewed some high profile VCs and Private Capital experts on the recent “private IPO” trend. Great topic, catchy title and excited that BootstrapLabs will be joining the discussion live at her upcoming Global Alternative Funding Forum on November 6th in Los Angeles. Don’t miss it!

Having lived in Silicon-Valley for over 16 years as an entrepreneur, investment banker and tech investor, I have had the privilege to work with David Weild, count Will Bunker among my friends and co-investors, and have met with both Tim Draper and Andrew Romans. And I cannot help but wonder what the impact of these billion dollar companies going for Private IPOs will be on the liquidity cycle of Venture Capitalists.

I will skip some of the basic premise nicely outlined (or should I say revealed) by David Weild on his research paper, Why are IPOs in the ICU? and outline some of the basic benefits provided by standard IPOs:

- Public visibility with main street on a global scale,

- Increased trust with partners and providers,

- Promise of cheaper and faster access to capital to grow the business, make acquisitions and attract talent,

- Ability to offer liquidity to existing investors that had supported the company until then (average startup age at IPO is 7+ yrs lately, and trending up) as well as employees. These liquidity events do not happen at the IPO stage but usually during a Follow-On (FO) offering, as main investors and management teams are considered insiders and are under lock-up agreements for 180 days post IPO (and subject to trading limitations thereafter).

- Promise of rapid stock price appreciation driven by company’s growth and positive wall street analyst coverage

Now, let’s take a look at the benefits provided by “Private” IPOs:

- Unicorns are enjoying tons of (free) publicity, which could certainly qualify as the equivalent to going “public” from a notoriety stand point,

- While a lot less public (financial and operational) information exists about these Unicorns due to their private status, it is fair to assume that partners and customers alike are more inclined to provide them with the same level of trust, credibility and most favored nation terms as if they were publicly listed companies,

- In the current market, one could easily argue that you can raise faster, cheaper and even more capital in the private market if you are a Unicorn vs. a company filing for an S-1; and the best part of it is not being subjected to daily Wall Street scrutiny as Twitter has painfully experienced in recent months,

- This one gets interesting. There is little information out there but these large “Private” IPO rounds often include some – at least partial – liquidity for the founders, early investors and sometimes employees. The average Unicorns’ age is about 9+ years according to Beau Laskey at SVB , which is longer than the life of most VC funds. As such, it should come as no surprise that VCs, especially the ones that came in early, would seek liquidity in those later stage mega rounds.

Unicorn are not overnight successes. As the saying goes in Silicon Valley, Overnight Success takes 10 years!

- Valuations are sky-rocketing in the private market once a company reaches Unicorn status…and one has to wonder if it is due to sheer speed of execution and the breath-taking growth rate experienced by these startups, or a demand driven phenomenon where every deep pocket investor wants to ride this rising giant sooner rather than later, and deploy a large chunk of capital into it for a 1.5-3x return. These returns sound really good, especially when you are able to deploy over $100M at a time after some of the major risks appear to have been removed. In comparison, public market returns have eroded and it is getting harder and harder to find alpha at scale.

Unicorn Valuation Surge in the Private Market:

This is a one year old chart: Uber is now worth $10Bn more!

Are Later Stage Investors Valuation Insensitive Due to their Preference?

Andrew Romans had an interesting point in Victoria’s article in that the last money in gets liquidation preference (and sometimes anti-dilution protection in the event of a down round). That would basically make those investors valuation/price insensitive as they would get their money out first in case of trouble and that the valuation of these companies would likely not fall below their investment amounts to begin with. But in case of Qualified IPOs, these liquidation preference would go away and even if the opening price is higher than the last round of funding valuation, nothing would prevent the stock from tumbling down. See this good post on IPO down rounds.

Are Insiders Allowed to Lock-in Profits Quietly?

Another risky dynamic at play here is the liquidity provided to insiders as part of these later rounds. In a public setting, if an insider sells his shares he would need to disclose it to the public; but in those mega rounds of financing, only major investors are posted on the transaction structure, leaving out of the loop a lot of people inside and obviously outside of the company. Wouldn’t you think that knowing that the founder(s) of your company have locked in some of their gains would be important news?

Potential M&A Suitors Evaporating by the Minute

While M&A still represents between 90 and 95% of the return on capital for VCs, the list of potential acquirers for Unicorns is shrinking by the minute as their valuations are significantly higher then those of the very incumbents they seek to disrupt. As an example, Group Accor ($9Bn market cap.) can no longer buy AirBnB ($25Bn).

Ultimately the Losers are Public Institutional and Retail Investors

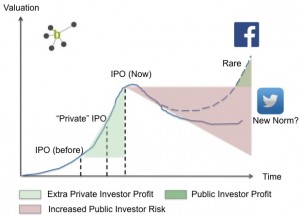

Maybe a good way to look at what is happening is by drawing a chart with valuation against time, with a typical Unicorn curve, pre- and post- IPO.

In that context, it is pretty clear that a lot of the growth and value that was once captured by public investors (including you and I as retail investors), is now being captured by the late stage growth and cross-over investors, while increasing the risk/return profile of Unicorns in the public market once their valuation has been “maxed out” in the private market.

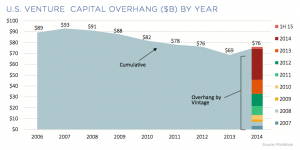

VC firms are flushed with $75Bn of dry powder

so you can bet they will want to party on!

I remember ringing the bell at the NYSE in 2009 with my startup InsideVenture, for the launch of our new product, dubbed “HPPO” for Hybrid Public Private Offering. At the time, VC-backed IPOs and Wall Street in general had ground to a halt after Bear Stearns and Lehman went down. We talked about ways to fix the IPO market and “orderly transition” of the cap table with top VCs such as Ray Rothrock from Venrock and Scott Sandell from NEA.

Ringing the Bell in 2009 at the NYSE for our Product Launch:

HPPO – Hybrid Private Public Offering

With new regulations such as Reg A+, allowing private companies to crowdfund up to $50M and trade their shares on secondary markets, it looks like the future might be just that, a world where public investors are finding their way back into ventures, earlier in the growth curve!

As Bill Gross told us last Thursday, “Timing is everything”…we were just 7 years too early!

DreamForce & BootstrapLabs Event in SF

/in Blog, BootstrapLabs /by Mark MavroudisThere are about 150,000 extra people in San Francisco this week. Once again it is time for DreamForce, Salesforce’s annual conference for customers, vendors, and developers. Billed as “the premier event in the tech community” and San Francisco’s largest tech event, DreamForce attracts people from around the world.

On Monday, we hosted a Silicon Valley Insider program for a large group of French business people who were here for DreamForce. Representing companies such as Accor Hotels, Pernod Ricard, SNCF, and AXA, these senior managers and executives wanted to get behind the scenes introduction to Silicon Valley before heading off to the exhibits, workshops and after-hours parties.

BootstrapLabs’ co-founder, Ben Levy, started the morning with a presentation titled “Silicon Valley: Unicorn Factory”. Ben covered topics such as disruption and innovation, explaining why what happens here in Silicon Valley is not yet replicable anywhere else in the world, and why creative entrepreneurs are still motivated and obligated to come join this vibrant and exciting ecosystem. At BootstrapLabs we have been talking about many of the important trends we are seeing – IOT, FinTech, and the Future of Work – and Ben shared some interesting facts and stats, stressing the importance of execution.

The event for our French visitors continued with some short presentations from startup companies working in location tracking technology (Navisens), on demand marketing software (Doz) and supply chain security solutions (Vantage Point Analytics). We concluded with a presentation on data science, and the need for more trained data-scientists to manage, understand and derive business metrics from all the “big data” that is being created daily. As they heading back into the crowds of DreamForce, the attendees of our program left with a better understanding of the technology, startups, and investors that come together to make Silicon Valley happen.

5 skills founders better verify before deciding to add a core team member

/in Blog, BootstrapLabs, EIR, Founder's Advice /by guestcontributorToday’s guest post is from Tommaso Di Bartolo.

Startup is an amazing crazy ride. Unlike corporate business, every moment in startup makes you remember you live because of the thrilling paths and the amount of emotions you experience. The most compelling phase in a startup is the period of time before the product finds its product-market-fit. The time where you think you know what problem you are solving – but the market is not reacting the way you thought and the value you offer still hasn’t been proven out. This occurs usually in the third phase – out of four – of a startup life cycle. It’s the phase where the vision is being squeezed, where getting funded is hard if there isn’t enough traction, where releasing a sexy product is challenging if the right people aren’t on board, and the time where adding the “right core team members” is tough. But what does “the right” people mean in this case? What are the key attributes, skills or even qualifications the handful of key people you’ll call core team members will have?

Once upon a time, there were 3 friends that met at Stanford: a computer science engineer, a design guy and a business grad. During lunch time on a spring afternoon they, all together, came up with an idea, the prototype of which they released short after. They easily got traction and therefore funding from TOP Tier investors on Sand Hill Road. With the money they hired a stunning team, invested in developing a great working product which scaled globally and were acquired only 36 months later for a $1B …

… and then we all woke up … good morning!!!

The startup ride is a very turbulent one and “luckily” not for everybody – otherwise we would have even more competition ;-). Often we read about “overnight” successes – but it only was overnight for those who were not part of the journey… as stories like the one above don’t exist! Nor are most of the startups representing an “A-Team” that have already done it before. More often, early stage startup teams are a bunch of inexperienced hustlers, hackers and hipsters driven by the sentence to “change the world”, and more than 50% of them split up within the first 12 months… that’s where the shit hits the fan. Now, only teams who’ll write the most painful stories actually really make an impact. But what is it they do differently?

Startup Mindset goes over Education

While upcoming entrepreneurs have guidelines on how to build a lean startup or how to build a demand engine for products – there’s a lack of blueprints for how / what to consider to put the right people together, and therefore we underestimate the importance of how much business relies on relationships and their communication. And that behind every “tongue”… there is a mindset that is responsible for letting us do things the way we do… or simply don’t do. Mindset is often the make or break deal, especially in the early days. In other words, the people’s strength of mindset is what at the end makes a startup succeed or die. It’s what makes startup teams keep fighting and finding ways, or give up.

After 15 years of entrepreneurial experiences on three continents and four startups, I’ve learned the hard way that core team members’ soft skills were more important than their educational background. While I’m not saying that education doesn’t matter, make sure specific characteristics within core team players exist, especially during the initial delicate phase where things are not settled.

The biggest “bug” in an early stage startup is a “mismatched mindset” – Tommaso db

Watch out for genes – not qualifications

There’s a difference between the way you recruit a CFO for when you are scaling business and between “handpicking” a Senior Backend Engineer for an early stage startup. For the CFO you mainly consider qualifications, experiences and assure yourself with reference checks. For the Senior Backend Engineer the story is quite different. In an early stage startup it might be the case that you do have an MVP – but still not enough traction to prove assumptions and enchant with business success. Or – like in many early stage startups – you don’t have deep pockets and sweat equity is the compensation model to go to.

Even though on one hand your funds might be low and the pressure to move ahead with product development is high, you better make sure the person you decide to add as a core team member qualifies mindset-wise – before you match educational skills. This helps you avoid investing time and creating expectations with a candidate that sooner or later might leave if their mindset simply doesn’t fit. Don’t let circumstances hurry you on everything you are doing or pressure your decisions.

Don’t delude yourself because of an educational background or due to lack of options – but seek for genes that are crazy enough to go through the real side of your daily business.

…continue reading “5 skills founders better verify before deciding to add a core team member” on Tommaso’s blog WhatItTakes

Tommaso Di Bartolo | @todiba

Tommaso Di Bartolo | @todiba

Expert in Residence, BootstrapLabs and CEO at swaaag.

Tommaso is a serial-entrepreneur with 2 exits, an advisor & an angel investor. He lives with his family in Silicon Valley.