Today’s guest post is from Martin Roll.

I am often asked when entrepreneurs, start-ups and younger companies should start to build their brands. The implicit impression by those asking is that branding and brands are for later, not in the early stages. I could not disagree more. The earlier you start it, the better chances of scaling and globalizing your brands. People don’t buy products and services, they buy brands.

Building and sustaining brands are not a luxury for entrepreneurs and start-ups, it has become necessity in order to compete in a globalized world where brands play an important role in building strong market positions and driving value.

The emergence of global Asian brands and the bold aspirations by Asian leaders should serve as great inspiration for entrepreneurs and start-ups as illustrated in the following.

The rise of Asian global brands: From “nice to have” to “need to have”

An increasing number of Asian brands are becoming successful well beyond Asia. But with two-thirds of the global population, growing economies, a rapidly growing middle class with an increasing disposable income, Asia still boasts only a handful of powerful global brands which is a cause for concern, and a great untapped opportunity. But given the size and volume of Asian business today, it is evident that Asia could build many more prominent brands and capture more financial value from better trade power, price premiums, customer loyalty and other important metrics.

Building and sustaining brands are not a luxury for Asian firms any longer, it is a necessity in order to compete in a globalized world where brands play an important role in driving value.

Therefore, in an updated and revised edition of the bestselling book Asian Brand Strategy, I have provided a comprehensive framework for understanding Asian branding strategies and Asian brands, based on new research and supported throughout by a wealth of new case studies from several Asian countries.

Asian Brand Strategy provides insights, knowledge, and perspectives on Asian brands and branding as a strategic tool, and provides a comprehensive framework for understanding Asian branding strategies and Asian brands, including success stories and challenges for future growth and strengths.

Asian Brand Strategy includes theoretical frameworks and models and up-to-date case studies on Asian brands, and I believe it is a must-read for Asian and Western business leaders as well as anyone interested in the most exciting region of the world.

Will Asian companies challenge the global brands?

Several indications show rapid progression in the right direction for a selection of Asian companies where branding as a strategic tool has become more recognized and accepted in their boardrooms. This is also driven by the increasing attention on branding and its value-driving capability among stakeholders, media and opinion makers across Asia.

Asian companies can have great intentions and aspirations to move up the value-chain through branding to capture the financial and competitive benefits, but to achieve these objectives successfully, Asian companies must follow a comprehensive brand strategy framework supported by a systematic process throughout the organization.

Successful implementation of these processes will help Asian boardrooms to better compete in the global marketplace, and in achieving sustainable revenue and cash flow streams for the future.

In my book, I use the Asian Brand Leadership model to illustrate the paradigm shift that Asian brands need to undertake in order to unleash their potential:

First, mindsets and practices need to change in Asian boardrooms. Asian Brand Strategy invites a complete shift in the way that Asian boardrooms think of branding:

- From a tactical view to a long-term, strategic perspective

- From brands viewed primarily as advertising and promotion to brands as strategic assets

- From fragmented marketing activities to totally aligned branding activities linked to business strategy

- From a vision of branding as the sole responsibility of marketing managers to branding as the most essential function of the firm led by the CEO, CMO and board room

Second, this new perspective must be grounded in in-depth understanding of consumer behavior patterns. Asia is not a homogeneous entity. More importantly, Asian countries are more and more traversed by cultural flows permeating the region: cinema, music and fashion trends that at present extend beyond national borders to capture the imagination of millions. Branding and brands do not operate in a vacuum; they are closely linked to developments in society, to people and cultures.

Third, managers wanting to succeed in Asia need to abandon the oriental Asia of the past. Asian consumers are all vying for an Asian type of modernity that has nothing to do with colonial imagery.

Fourth, to create iconic brands, Asian managers will have to become trendsetters. The perspective developed in Asian Brand Strategy is that, in order to be successful, Asian brands need to capture the spirit of the region, and lead the way by creating that spirit.

Finally, this shift can be achieved only if everybody in the company is convinced of the power of branding. This, in turn, can only happen through accountability and systematic monitoring of branding investments and performance. Organizations that utilize data-driven decision-making are more productive and profitable than their competitors.

Martin Roll | @MartinRoll

Martin Roll | @MartinRoll

Martin Roll delivers the combined value of an experienced global business strategist, senior advisor and facilitator to Fortune 500 companies, Asian firms, family-owned businesses and start-ups on how to build and manage strong, global brands as well as leadership of high-performing, marketing-oriented businesses. He is very experienced in engaging and advising clients at all management levels from business owners and C-suite leaders to functional staff across multiple industries and cultures. Author of Asian Brand Strategy.

Nicolai Wadstrom, Founder & CEO of BootstrapLabs

Nicolai Wadstrom, Founder & CEO of BootstrapLabs

Magnus Bergman, Venture Investment Partner at BootstrapLabs

Magnus Bergman, Venture Investment Partner at BootstrapLabs

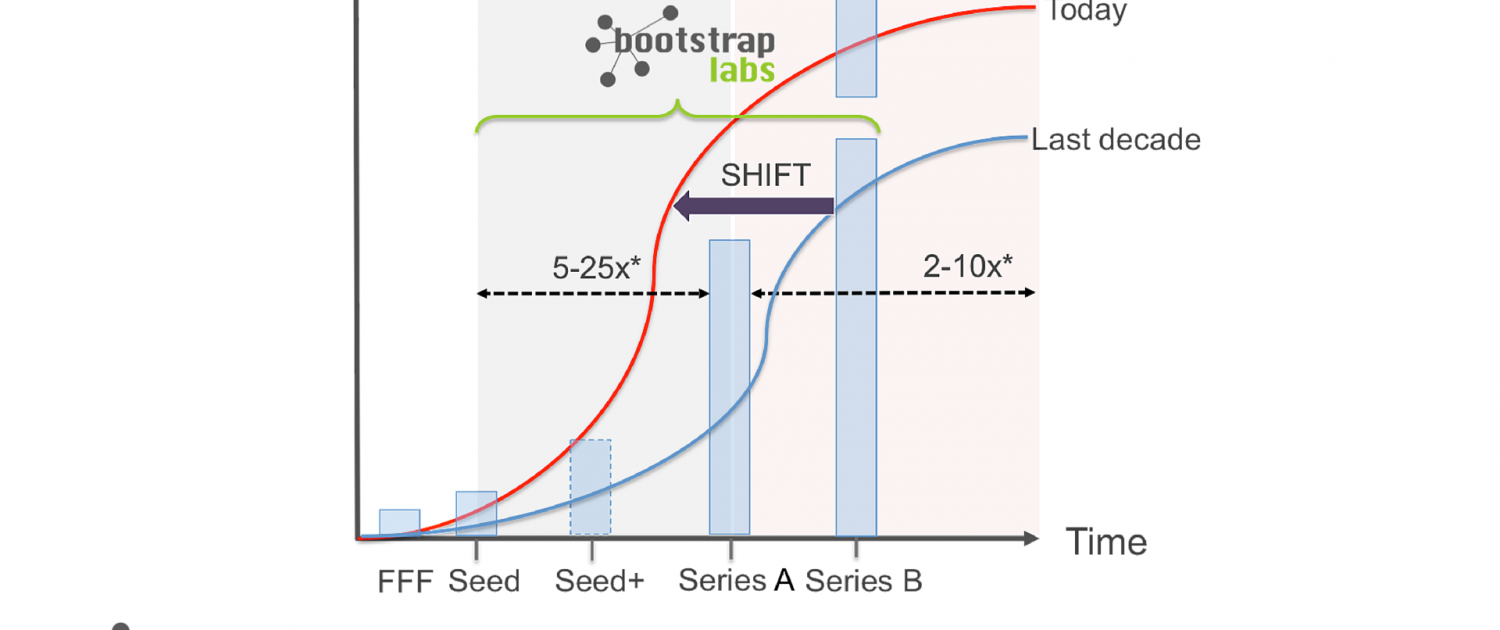

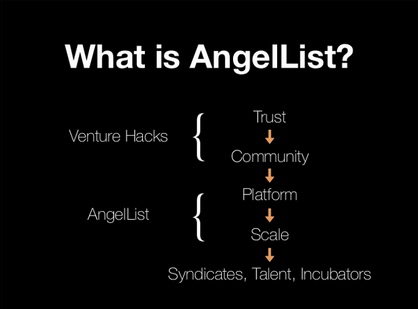

BootstrapLabs is partnering with Gil Penchina, the #1 Syndicate Lead on AngelList with over $6.5M in backing (more info below), and launches its syndicates.

BootstrapLabs is partnering with Gil Penchina, the #1 Syndicate Lead on AngelList with over $6.5M in backing (more info below), and launches its syndicates. Gil Penchina arrived in Silicon Valley in the 90’s and has since had an extraordinary career as an executive, entrepreneur and prolific angel investor. Today, he is one of the most successful angel investors in the Bay Area, and likely globally, with over $25 Billion in combined exits.

Gil Penchina arrived in Silicon Valley in the 90’s and has since had an extraordinary career as an executive, entrepreneur and prolific angel investor. Today, he is one of the most successful angel investors in the Bay Area, and likely globally, with over $25 Billion in combined exits.

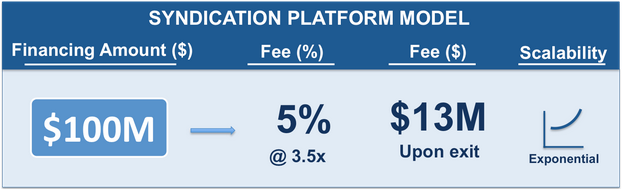

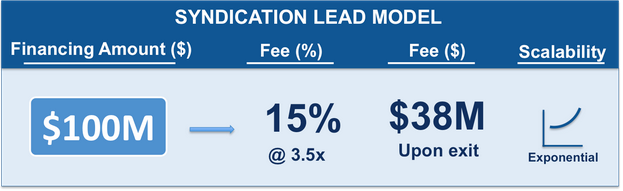

High profile angels usually build a group of “backers” – fellow angel investors – for their syndicate so that they can easily share investment opportunities with them and receive carry in exchange for providing them access, vetting and post investment value-add to increase success/outcome.

High profile angels usually build a group of “backers” – fellow angel investors – for their syndicate so that they can easily share investment opportunities with them and receive carry in exchange for providing them access, vetting and post investment value-add to increase success/outcome.